How We Built the Solution for GTM AI Without Realizing It

Few domains have as much appetite for AI transformation as GTM. Reality is paved with failed "GPT on my CRM" experiments. Most GTM AI is still expensive autocomplete.

The way GTM stacks evolved over the last decade doesn't work for the age of AI. We added a tool for every problem and tried to connect it back to the CRM. Adding another tool won't fix the AI problem. It created it.

The Point Solution GTM Architecture breaks AI

Most GTM architecture looks like this: Salesforce as the system of record. Point solutions around it. A hub-and-spoke-model.

The theory: integrate all point solutions into the system of record to get a unified view. It doesn't work that way.

The average enterprise runs 42+ GTM tools. Each one captures a slice of context. Each one stores it in its own database. Each one "integrates" with Salesforce by syncing some fields.

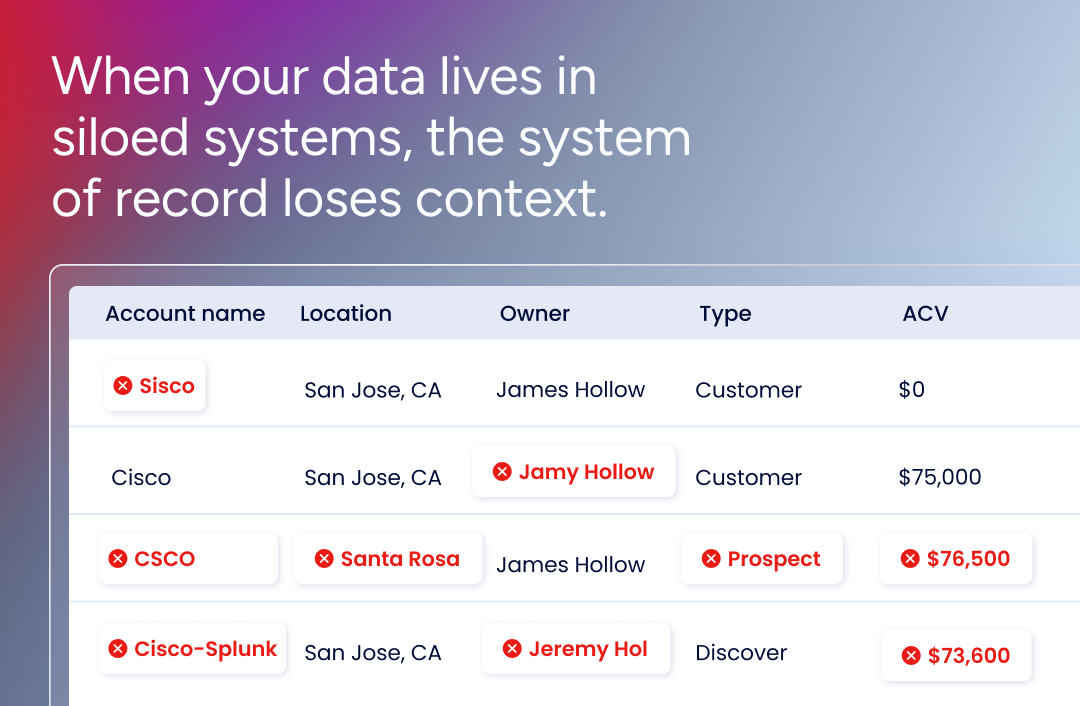

When your data lives in siloed systems, the system of record loses context.

When you try to connect it, it's a mess. So you hire a CRM engineer and a head of GTM systems. They're going to unify your GTM data. They pull from Salesforce, Gong, Outreach, 6sense, and your data warehouse.

What you find:

18 Ciscos. Your CRM has 18 different Cisco records. "Cisco Systems Inc." "Cisco" "CSCO" "Cisco Systems, Inc" "Cisco (different division)." They're all supposed to be the same company. Some have opportunities attached. Some have contacts. Some have both. Which one is right? Which one should your AI use? Now multiply this by your TAM.

Contact Mismatches. Sarah Chen appears as "Sarah Chen" in Salesforce, "S. Chen" in Gong, "sarah.chen@cisco.com" in Outreach, and "Sarah C." in your email logs. Same person? Different person? She changed titles three months ago, but only one system has the update. You have no idea if the actual Sarah received an email yesterday.

Hierarchy confusion. Is "Cisco WebEx" a separate account or a subsidiary? What about "Cisco Meraki"? Your CRM has them as separate accounts. Your data warehouse has them as one. Call recordings are mapped to the wrong ones.

Missing Normalization. Outreach says the contact is "VP of Sales." Salesforce says "Sales Leader, EMEA." ZoomInfo says "Head of Sales." Are these the same role?

Inconsistency. When did Sarah actually enter the deal? Salesforce says January 3rd (when someone manually added her). The email thread shows she was engaged December 14th. Gong has her on a call December 8th. Which is true?

Every scaled GTM organization has this. This is what your data looks like right now.

Integration doesn't solve this.

What It Takes to Fix The Foundation

GTM orgs in the pre-AI era never thought about infrastructure the way IT and engineering teams did. Now they need it.

To make GTM data AI-ready, you need infrastructure that does the hard work:

1. Entity resolution at massive scale.

Not just matching names. Resolving billions of entities across every variation, misspelling, abbreviation, and format. Knowing that "Cisco Systems Inc." and "CSCO" and "Cisco (WebEx division)" are all part of the same entity graph. Understanding the hierarchy, the subsidiaries, the relationships.

Entity resolution at this scale isn't a feature you can build. It's a decade of specialized infrastructure processing billions of relationships daily. Not a feature you bolt on. Not a set of rules you can set and forget.

2. Semantic normalization.

"VP Sales" = "Vice President of Sales" = "Head of Sales" = same role, same buying committee position. "Budget concerns" mentioned in a call = "pricing objection" in your taxonomy = risk signal for the deal.

You need a schema that makes GTM machine-readable, so AI can reason across systems that were never designed to talk to each other: entity types, relationship types, taxonomies

3. Hierarchy and relationship management.

Which Cisco record owns the relationship? How do the subsidiaries relate to the parent? When a contact moves from Cisco to Figma, how does that update propagate?

This requires a graph, not a database. Relationships, not rows.

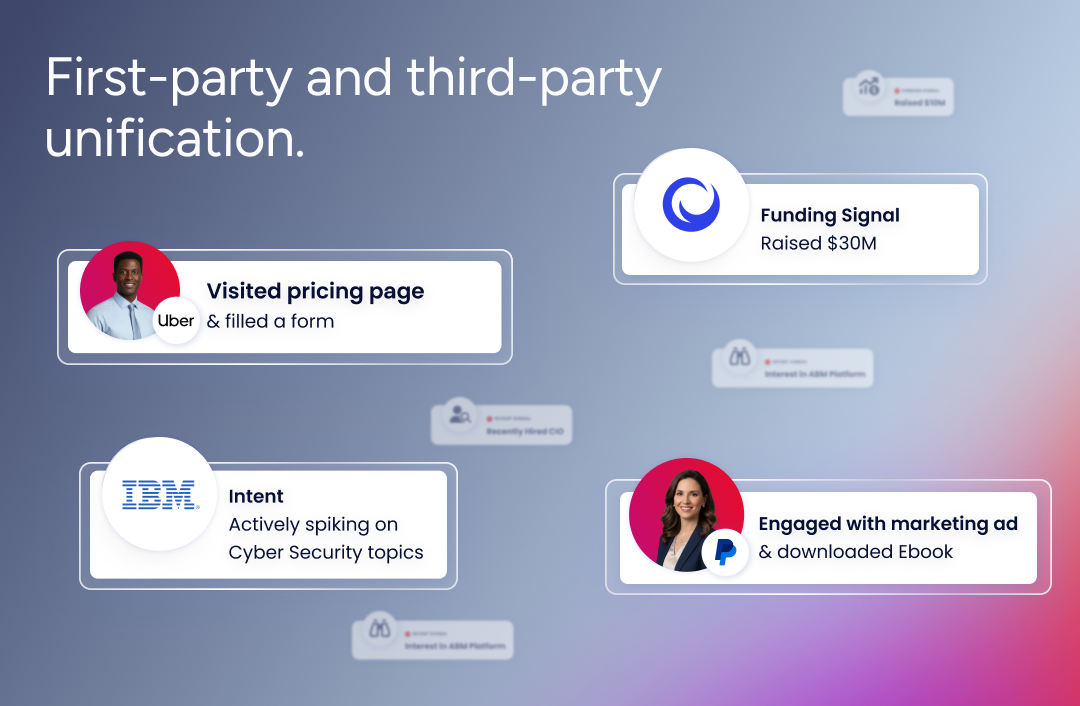

4. First-party and third-party unification.

Your internal data tells you what's happening inside the account. External data tells you what's happening outside: org changes, funding, intent signals. Neither is complete alone. You need unified profiles that combine both.

This Is ZoomInfo

We've spent 20 years building the world's largest B2B data unification platform. We resolve hundreds of millions of companies and contacts across every variation. When there are 18 Cisco records in your CRM, we know they're the same entity. We know Meraki is a subsidiary. We know Sarah moved from Cisco to Figma three months ago. We capture signals from the web, filings, news, and job postings (all unstructured and messy) and turn them into structured intelligence.

The same entity resolution and signal extraction we built for third-party data, now applied to a customer's calls, emails, CRM, product usage: cleaned and unified.

If you rebuilt the GTM stack for the AI era, you'd end up with ZoomInfo. We built this infrastructure for third-party data. Now we're applying it to GTM.

Unified Data isn’t enough: GTM Context

Getting the data architecture right matters. But a unified data foundation is not sufficient for AI to perform.

Your best AE just lost a deal everyone thought was a "sure thing." The CRM shows stage progression was normal, engagement was high, and pricing was competitive. What it doesn't show: the champion got promoted and the new decision-maker had a bad experience with your competitor five years ago.

Nowhere do you pay more for missing context than GTM. Open any deal in your pipeline. Look at the record:

Stage changed from 3 to 4. The close date was pushed two weeks. Amount revised down 15%.

The record ends there.

The CFO joined the last call and asked about ROI within six months – that's why the deal accelerated. The VP of sales went quiet for eight days because she was fighting an internal battle with IT over budget ownership, which is why it almost died. The 15% discount happened because of competitive pressure.

The CRM recorded the state change. It has no record of why it happened.

CRM captures "what" happened, the outcomes. AI needs the full trace: what was tried, what worked, what failed. Your GTM is missing the "why."

GTM Context

GTM Context is the causal chain behind outcomes. Let's look at the deal above:

December 3: Mike (champion) mentions competitor evaluation on call. Sentiment: concerned but not alarmed. Action taken: sent references who switched from competitor same day. Result: competitor deprioritized in follow-up call Dec. 5.

December 15: Sarah (procurement) joins email thread. Unusual timing, procurement typically enters at Stage 4, not Stage 3 for this segment & deal size. Context: she's 60 days into role. Likely aiming for early wins with aggressive negotiation incoming.

December 29: Technical call focused on implementation questions. Pattern match: this mirrors 847 deals where buyers had prior bad vendor experience. Probability of "security review" delay: high.

January 4: Champion went quiet for eight days. Historical pattern: when champions go quiet for more than five days at this stage, 62% of the time it's internal political friction.

A causal chain. Events linked to context, linked to patterns. Data structured so AI can actually reason about what to do next.

No GTM system captures this context today. That's why AI in GTM has been underwhelming.

Why Point Solutions Can't Solve This

Gong has the calls. It can tell you that Sarah mentioned procurement concerns at 23:47 in the Dec. 14 recording.

It can't tell you that Sarah entering at Stage 3 is unusual, that her behavior pattern matches "new-to-role" or that this specific pattern correlates with 34% longer negotiation cycles.

Outreach has the sequences. It knows you sent seven emails over three weeks. It can't tell you that the champion went quiet because of internal politics, that similar patterns resolve 62% of the time if you reach out to a secondary contact, or that this deal specifically needs a value-anchor before any pricing discussion.

6sense has intent data. It knows Cisco is researching "revenue intelligence platforms." It can't tell you which of your 18 Cisco records this maps to, who the actual decision-makers are in this specific evaluation, or that the real objection is implementation risk from a burned CTO, not features.

Each tool captures a slice of raw data. None of them captures decision context.

Integration doesn't fix this. Syncing Gong transcripts to Salesforce just puts raw data in another place. You still don't have the causal chain. You still don't have patterns. And GTM scale breaks any context window.

The GTM AI Context Architecture

Today's GTM Data is structured as a database around the Salesforce Model. Company Name, Industry, Deal Size. Static fields.

ZoomInfo's GTM AI is a context graph that stores relationships and patterns over time.

Sarah (Procurement) → entered deal at Stage 3 → unusual timing → pattern: new-to-role behavior → implication: expect aggressive negotiation → recommended action: anchor on value, engage champion to advocate for you.

In practice, this means capturing:

People and their relationships: who influences whom, who's blocking, who's championing, how dynamics shift over time

Actions and their outcomes: what each action responded to, what it aimed for, whether it worked

Patterns and predictions: what 10,000 similar deals suggest happens next

Exceptions and explanations: why things slipped and what that reveals about real blockers

This GTM Context Graph makes the context machine-readable. We spent $500M+ acquiring Chorus and Workbounce not for their features, but for their context engines.

The ZoomInfo GTM AI context layer powers GTM Studio and GTM Workspace as well as our upcoming MCP for enterprise environments, and through the Claude, OpenAI, and Google marketplaces.

The companies that capture decision context will compound learning. Everyone else will try to fix the 25-year-old database. The gap widens every quarter.