For many startups, the road to success is lined with meticulous plans to raise money. In exchange for much-needed capital, outside investors receive equity, or ownership, in the company.

Each one of these rounds reveals a new valuation for the company and provides much-needed funds for growth.

The problem with raising money, according to VC and author Richard Harroch, is “it’s almost always harder to raise capital than you thought it would be, and it always takes longer.”

So if you’re planning on raising money and know about the bare basics of funding, but are curious to dig deeper, this guide to funding types can help.

Common Types of Startup Funding Explained

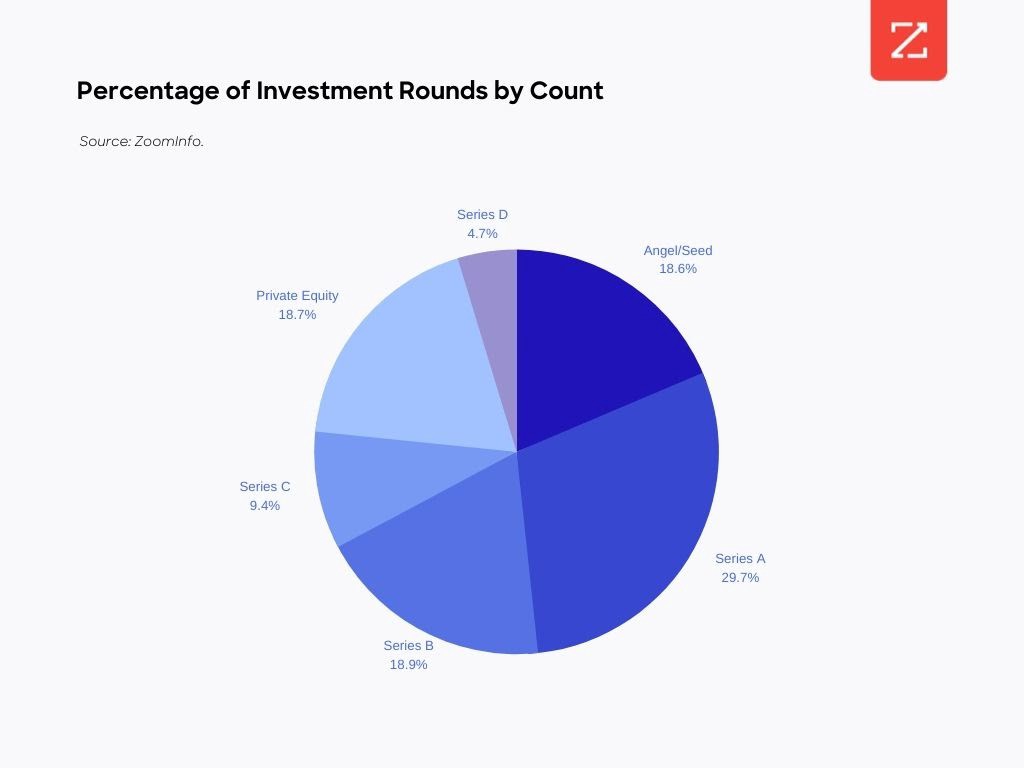

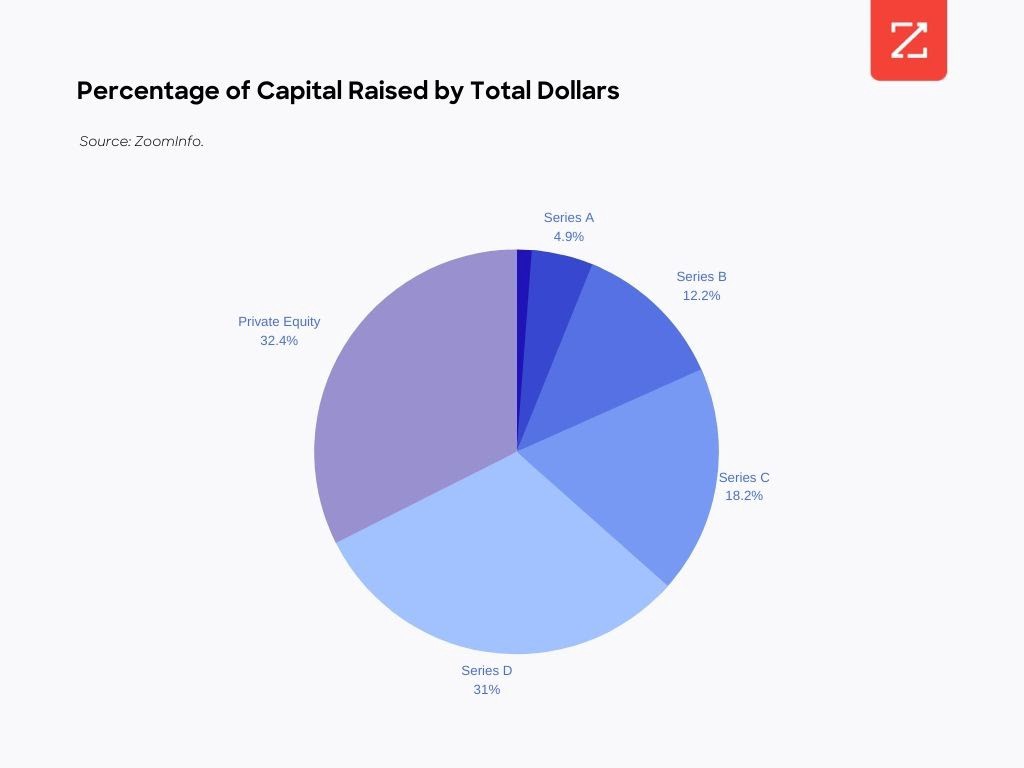

The most commonly seen funding source — according to ZoomInfo’s analysis of companies that have received various rounds of funding in 2019 and 2020 so far — are outlined below. Where possible, each stage is supplemented with the average amount of funding to further our understanding of typical practices and trends.

Friends, Family, and Fools

The “Friends, Family, and Fools” is essentially a company’s support group which consists of pre-seed, angel and seed funding, and is often seen as “friendly” and flexible with regard to repayment plans and interest rates. Each year between 35–40% of startup ventures receive capital from friends and family. As for the “fools,” the term is a lighthearted nod to the risks associated with funding the early beginnings of a business.

Pre-Seed: Companies in the very, very early stages of funding may look to raise pre-seed funding, which often consists of fairly low amounts, typically around 50K-250K.

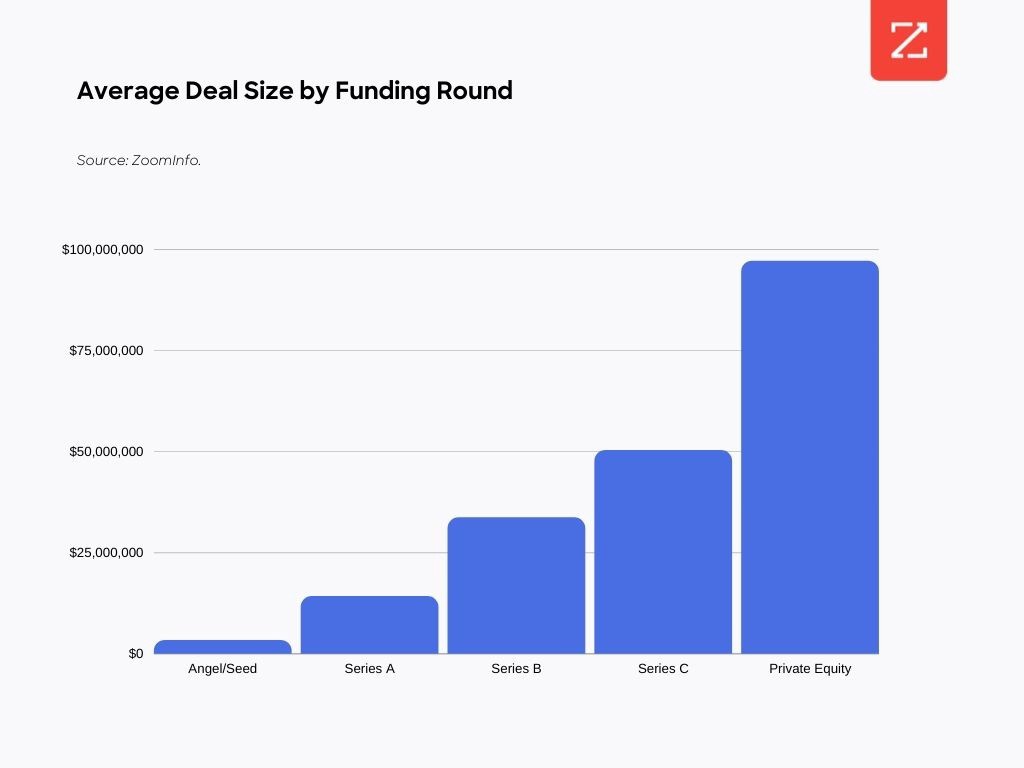

Angel/Seed: Often interchangeable, angel funders or seed investors plant the seeds — as the analogy goes — to help nourish a business in the early stages of growth. According to ZoomInfo’s analysis of over 14 million companies, seed and angel funding (with seed funding sometimes closely following angel fundings, but I won’t get too technical here), averaged $3.4 million per deal. This amount plays a huge role in solidifying the building blocks of a company.

The Seeds Have Been Planted: The ABCs of What’s Next

Trailing the earliest seed rounds, Series A and B mark the next stage of investments and help ensure that businesses increase customers or improve operations. Later in the game, Series C rounds focus on fueling the growth of more established companies. One of the main differences in these funding rounds entails the amounts companies look to raise under each stage.

Series A

Once a company is on more solid footing — seeing a relatively predictable flow in revenue and a working product — it may turn to Series A funding. In this stage, “investors are not just looking for great ideas. Rather, they are looking for companies with great ideas as well as a strong strategy for turning that idea into a successful, money-making business.” With the average Series A being over $14 million, roughly 4X the average of “Friends, Family, and Fools” rounds, it’s clear that investors are engaged in more due diligence on the “money-making” aspect of investees.

Series B

This series of funding dives deeper into the development stage of a business, during which startups forecast readiness to grow their customer base and increase operations. ZoomInfo indicates that Series B saw a big bump in the average deal, to $33.7 million. While Series B is similar to Series A in terms of the key stakeholders and processes, Series B often interweaves “a new wave of other venture capital firms that specialize in later-stage investing,” with a fresh proclivity to invest more capital.

Series C

Companies that have seen quantifiable, steady success may opt to raise more money to funnel into their already thriving business. Series C funding usually applies to established companies now on the hunt for “additional funding in order to help them develop new products, expand into new markets, or even to acquire other companies.” Average deals in this much later stage, according to ZoomInfo, are upwards of $50 million.

Private Equity

Private equity is funding from an equity firm or hedge fund and belongs to the later-stage round of the game. With this route of investing, firms are hands-on and exit-oriented, instrumenting a detailed plan to contribute to a company’s transformation and/or cash out well ahead of funding. On a more personal note, it was a Private Equity firm that gave rise to “ZoomInfo Powered by DiscoverOrg,” the initial name given to ZoomInfo’s combined platform. By funding DiscoverOrg’s purchase of ZoomInfo, the firm played a vital role in consolidating the major players in the space.

Usually, this round is a less risky investment for a firm to take on, given that the company at hand is often well-established at the point of funding. In general, private equity plays a huge role in the investment market today, and — according to ZoomInfo data — private equity accounts for around 30% of capital invested over the last year and makes up nearly 20% of the deal volume.

The Slightly-Less-Common Funding Types

Series D:

Considerably less common than Series C funding, companies that pursue Series D investments typically do so before for one of two reasons: they have not yet been able to reach their goals from prior funding, or they seek to increase the value of their business before pushing to IPO. Amounts and deals vary significantly depending on the objective.

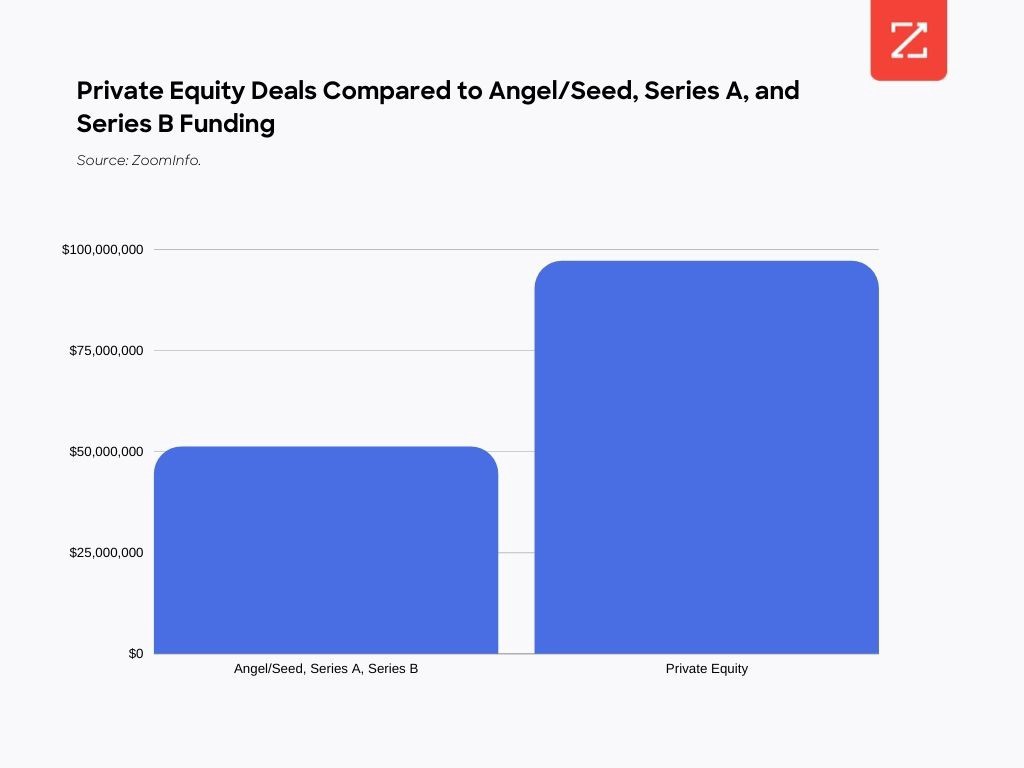

Average private equity funds were slightly more than $97 million per deal — almost double the average of angel, Series A, and Series B investments combined — according to data from ZoomInfo.

Debt Financing

In this case, individuals or institutions providing financing are not offered a stake in the company — but instead, these entities act more like creditors that lend money and await repayment of debt with added interest. ZoomInfo’s analysis concluded that, on average, amounts financed rose over $330 million in this category.

Interestingly, compared to 2019, debt financing for months starting in March 2020 saw near double increases, with April 2020 receiving a whopping $1.2 billion from 55 deals, compared to just under $100 million from four deals made in April 2019. The jumps may, perhaps, indicate that the pandemic is not just fueling — but also expediting — the need for companies to raise more money. Case in point: Back in March of this year, “buffeted by the coronavirus outbreak, the Walt Disney Co. said it had raised nearly $6 billion in a debt offering.”

Stock Issuance

This type, like several others listed above, is rich in particulars and nuances. For the purposes of this article, however, here’s a short and sweet definition: the maxim number of issued shares of stock that are made available to a private or public company’s shareholders. These shares include the stock a business sells to the public to raise capital, as well as the stock issued to insiders as a part of their benefits or compensation packages. According to ZoomInfo, the average amount of stock issuance is slightly upwards of $300 million.

Convertible Note

In the most basic terms, a convertible note is a short-term debt that “converts” into shares or equity upon issuance of the loan; this is different from a situation where an investor receives their money back with interest. Sometimes thought of as an “in-between” stage that helps businesses make it to the next round of funding (from Series A to B, for example), this note “converts with a discount at the price of the new round.”

That’s a lot of information to digest, I know.

The broad topic of “funding” is not always the easiest to stay current on; the processes involved are highly subjective, deal with countless stakeholders and evolving, minute details. Nevertheless, this list will hopefully guide you on your way to semi-fluency in the subject matter.