For sales leaders, data isn't everything " it's the only thing. While having too little sales data means your team is deeply inefficient, trying to take on every metric available will overwhelm your team and kill their chances of working effectively. That's why it's crucial to know how to support your sales team with the right data and tools.

To find the right balance, you’ll need to narrow in on the right set of key performance indicators (KPIs), connect them to your team and company values, and build quotas that back it all up. Here’s how to make sales data work for you.

What is Sales Data?

Sales data is a broad category of business intelligence that encompasses everything about the sales process and gives individuals and leaders a way to view and optimize their performance. In particular, sales data often refers to the critical metrics and KPIs that describe and measure the steps in finding prospects, qualifying leads, and winning deals. Examples include revenue per sale, average customer lifetime value (LTV), Net Promoter Score (NPS), and revenue by product.

You can collect this information using your customer relationship management (CRM) system. But you also need tools to analyze your sales data so you can uncover key insights and trends, track progress on deals, measure team performance, improve your sales forecasting, and much more. Also, you need to identify the best sales metrics to track.

Important Sales Metrics and KPIs

The fastest-growing companies use sales data and analytics effectively. If you're aiming to do the same, you need to strike that sweet spot between tracking too few sales metrics and trying to track them all. The following 10 KPIs can help you find the balance that works for your market and your team. Use them to form the basis of a powerful sales analytics program, and they'll allow your growing sales team to thrive without being buried in numbers.

1. Sales Growth

It's hard to think of any approach to sales analytics that doesn't take sales growth as its foundational metric.

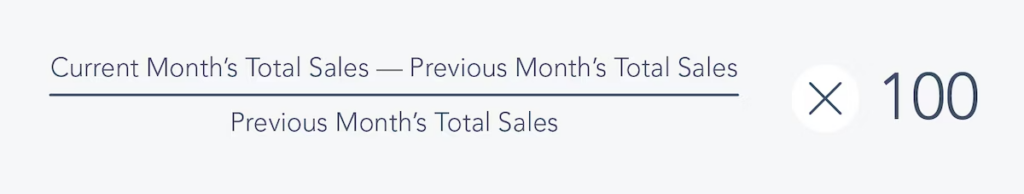

Analyzing sales growth involves measuring revenue increase over a fixed period of time. It can be measured using a simple formula:

Sales growth is intimately connected with revenue and profitability. Reliably tracking this metric can act as the foundation of a much broader sales strategy, including which other metrics you include in your sales analytics plan.

2. Sales Targets

Sales targets help determine your company's growth and form the basis of your company's revenue.

Well-defined sales targets unify each level of your company, from executive to salesperson, behind a clearly understood objective. This kind of alignment, particularly between adjacent departments like sales and marketing, is fundamental to a consistently successful sales motion.

Start by assessing your performance against business objectives, as well as any changes you'll be implementing during your next sales period, such as new sales pods, the expansion of current accounts, or new investments.

It's helpful to make your targets dynamic, with a general focus on short-term performance, to make forecasting easier and motivation more sustainable. Targets that are too far in the future can be as bad for motivation as targets that are unrealistic.

Visual aids like sales leaderboards are an excellent and easy way to track this metric. They are visible throughout your team and a constant frame of reference for your sales team's efforts.

3. Sales Funnel

Finding weaknesses in your sales funnel should be your top priority.

Each stage of the buyer's journey has a different dynamic, so measure your sales team's success at each one. You will almost always find progressively fewer prospects at each stage. However, if you go from 40% agreeing to a demo to only 8% actually agreeing to buy, it’s clear that the process needs to be amended.

Where you're seeing opportunities close will determine your course of action:

Loss in the early stages of a prospect: Is your content performing? Are you targeting the correct prospects, with the right approach, at the right time?

Loss after a discovery call: Is your team up to date on best practices for on-the-phone selling? If not, address this deficiency in the coaching aspect of your wider sales-enablement program.

Loss after a demo: The success of your demo is absolutely key to a sale. Is your demo intuitive and easy to use? Does it give your prospect a good feeling about the ease of onboarding and potential support? Most importantly, is it representative of what your salespeople are selling during the discovery call and what your content is advertising?

Loss before buying: If you're falling at the final hurdle, you may need to evaluate your team's approach to negotiation and your wider approach to pricing, including things like baseline pricing, tiering, and add-ons.

4. Pipeline Velocity

Measuring pipeline velocity (PV) is a sure way to bring targeted improvements to your sales process. PV will tell you how much money you have coming through your business per sales cycle. Begin your measurement of pipeline velocity using the following formula:

Observe the rate of change in your PV and the metrics that compose it. Consult your metrics to find the root cause of any unprecedented spikes or drops. Looking into each individual component of pipeline velocity allows you to see where process improvements will be felt most.

A better grasp of your conversion rate, especially combined with a robust understanding of your sales funnel, will allow you to see where the buyer's journey is stalling. This will help you improve the number of qualified opportunities.

An understanding of where opportunities were lost will show you how to improve your win rate. Opportunities can be lost at any number of stages on the buyer's journey, such as:

Poor pricing: Are your price points effectively tailored to market rates and your customers' likely budgetary constraints?

Timing of approach: Are you targeting companies that are at a point in their progression where your product can be of use to them?

Poor targeting: Are you reaching out to people at prospect companies who have the authority to make a deal?

Poor pacing in the sales funnel: Are you giving your leads enough time to review the materials/offers you're sending them? Are you giving them too much time, resulting in lost momentum?

Lowered demand: Is your product is no longer a priority for the customer?

To increase your deal size, consider the balance you're striking between low-value and high-value deals. To reduce potential inconsistencies in pipeline velocity, keep that balance consistent and coach your team to prioritize either high- or low-value selling, depending on what best serves your needs.

5. Lead Generation & Conversion

Your understanding of lead generation and conversion metrics can never be too thorough. It requires tracking several types of data, giving priority according to the scale of your company and your product.

Quality & Volume:

Your company’s sales focus will determine whether you prioritize high-volume leads or high-quality leads. Use lead-scoring models to identify the most promising leads.

Leads by Lifecycle Stage:

Define your product's lifecycle stages relative to your sales funnel. After making those definitions, measure the lead types and conversion rates observable at each stage.

Leads by Source:

Determine the differing lead sources you have bringing traffic in (direct, referral, organic search, paid social) and measure for success by offsetting it against the cost-effectiveness of each source.

Rate of Upsell/Downgrade:

Your existing customers count as leads too, and you neglect them at your peril. Assess the rate of upsell or downgrade among your existing customer base.

Applying sales analytics effectively to lead conversion also requires you to keep track of a few separate metrics, which can include:

Revenue Contribution vs. Cost of Leads:

While every new conversion will bring money in, you can't make money without spending it. Take the percentage that newly converted leads are contributing to total revenue compared to existing accounts within the same sales period and offset the costs against the costs you incurred by finding, nurturing, and converting those leads.

Number of Conversions by Approach to Nurturing:

Speaking of nurturing leads, most leads need some nurturing before you can convert them. When considering the quality of your nurturing approach, pay particular attention to things like sales scripts and content strategy and compare them against the time your salespeople spend on nurturing.

If your conversion rate is too low compared to the time spent, consider changing your approach.

6. Average Contract Value

As vital as newly added sales pods are to powering revenue increases, increasing average contract value (ACV) is an even more powerful driver of exponential growth.

Measuring and improving your ACV allows you to build revenue without having to constantly exceed your month-on-month customer growth numbers. It's actually both easier and cheaper to sell to existing customers than to new ones. Some of the fastest-growing companies prioritize upselling in order to increase ACV and drive revenue.

You can't drive ACV higher if your sales team is accustomed to bargain pricing. Be daring, and calculate when it's time to ask your clients for higher fees on an upsell and to present higher starting prices to prospects.

7. Product Performance

The best sales analytics program in the world is useless if your product is not performing. Product performance can generally be measured in terms of the revenue your product is bringing in and the volume of orders you're receiving and fulfilling.

If your product suffers an otherwise unexplained slump (not accounted for by the metrics involved in measuring pipeline velocity), this may suggest a problem with your product's functionality.

The following three contextual cues are particularly valuable to track:

1. Buyer personas are perhaps the most important piece of context to consider when trying to improve your product performance.

Are your pricing tiers arranged for maximum appeal to your buyer personas?

Are you tailoring deals to the separate needs of different buyer types?

2. Analyzing Competitors is another key piece of contextual information for the evaluation of product performance:

Have competitors brought out a competing product selling at a lower price?

Have they targeted more accurately to buyer personas?

If so, you may need to consider expanding your range of services or modifying your pricing.

3. Assess your approach to customer relationships and how it might be affecting your product performance:

Consider whether your content strategy is adequately tailored to the buyer's journey with your product.

Observe whether your sales team, while nurturing existing client relationships, is seeking the right kind of constructive feedback that will allow you to make the right improvements to product performance.

Understanding customer's relationship with your product is key to improving your relationship with them. If necessary, press them on providing constructive critical feedback about your work.

8. Real-Time Competitive & Market Data

Taking on competitive and market data as sales analytics metrics can lead to more dynamic pricing and give your team an eye on other deals being made in your field. Identify and track these similar purchases, and use the information you gain to shape your approach to selling. There are several algorithmic analytical procedures, such as decision trees, that can make it easier to digest sales data.

When your product might be fairly new and you lack ample, comparable purchase information to use as a yardstick, look to track real-time competitive and market data instead. The use of dynamic pricing engines that combine these metrics with sales data strategies can lead to a sharper approach to sales.

The purpose of tracking metrics for real-time competitive and market data is to allow you to set more ideal price points, as well as targeting greater volume. This should lead to increased customer satisfaction.

9. Selling Time

Finding and nurturing leads, maintaining and upgrading existing customer relationships, offering support " there's a lot that your sales team does aside from the actual business of selling. Maximizing and optimizing their selling time is the most decisive factor in the immediate improvement to your sales team's performance.

Observe your team's workload and account for the proportion of their hours devoted to selling. Ensure that sell-time logs are implemented and outcomes tracked. Too much time spent on a single stage in a deal or repeated time spent on a potential deal leading to a closed opportunity can be red flags that your customer targeting is flawed.

Pre-sale actions like information gathering have been shown to take up significant portions of a sales team's time. A well-integrated CRM at the base of your tech stack can make looking for key customer information, like POCs and pain points, a quicker and more painless process. This will also help declutter your sales team's minds during sales periods " the less they feel they have to keep track of, the better they can execute mission-critical tasks like selling.

Lastly, as part of your sales enablement strategy, implement tools that allow salespeople to outsource or automate administrative/non-selling tasks where possible to allow them to make the most of their selling time. If you're looking at fulfilling a high volume of low-quality sales, being able to automate actions like email marketing can be decisive.

10. Team Performance

Sales enablement, and particularly training, is a process that should never stop.

A key aspect of sales data analysis is looking closely at your own team to make those important internal calls. Who's performing particularly well? Who has flaws in their game and could use some coaching to improve?

Connect KPIs to Your Team Values

Your sales team is smart " in a lot of cases, they'll know where they're thriving and where they need some coaching. Ensure you establish touchpoints where people can leave coaching comments with specific requests for areas they need help with.

When analyzing thousands of coaching-related comments from sales reps, we found that a huge range of topics was typically requested for training. The most frequent topic request? “The questions reps ask prospects.”

Establish Realistic Quotas

Take care to make your targets realistic. If less than 60% of your team is hitting their targets, it's highly likely that the quotas themselves are a bust, not your salespeople. The same is true if 100% of your team is hitting the marks without breaking a sweat.

Your Sales Enablement Strategy

Use performance over time to assess the effectiveness of your sales enablement strategy. Did the wider team's performance improve after those changes to the tech stack or degrade? Are your on-site workshops working for targeted reps?

The Team's Approach to ACV

Consider your approach to increasing your average contract value and tailor your expectations of your team's performance accordingly. If your approach to ACV is to cultivate client relationships and upsell, then ensure your team is making this a priority.

If you're looking to focus on converting a lot of new business within your next sales period, then what are your team's respective win rates on converting leads and how can they be improved?

Success in sales is quite often a matter of time " and how effectively your team spends it. The right sales analytics program will help you get the very best out of both your sales data and your sales team's time.