For years, go-to-market teams have been told that success depends on identifying and influencing an account’s buying committee or buying group.

That usually meant identifying the senior executives — directors, VPs, or C-level leaders — who held budget authority. They became the central targets of campaigns, demos, and sales motions.

But here’s the trap: when you only look at those people, you miss the broader influence map that determines whether your solution even makes it to the decision table. In reality, purchases are determined across a broader, more flexible buying network within a single company.

And if you want your GTM strategy to succeed, you must move beyond thinking of a deal as a one-on-one transaction with a director or VP who signs the paperwork.

From Buying Committees to Buying Networks

For more than two decades, I’ve worked with organizations to transform how they manage data — CRM, MDM, CDP, Marketing Automation, ERP, customer data, vendor data, and company hierarchies.

If there’s one lesson that keeps resurfacing, it’s that your success in B2B depends not on how well you find “the decision maker,” but how deeply you understand and engage the entire buyer network.

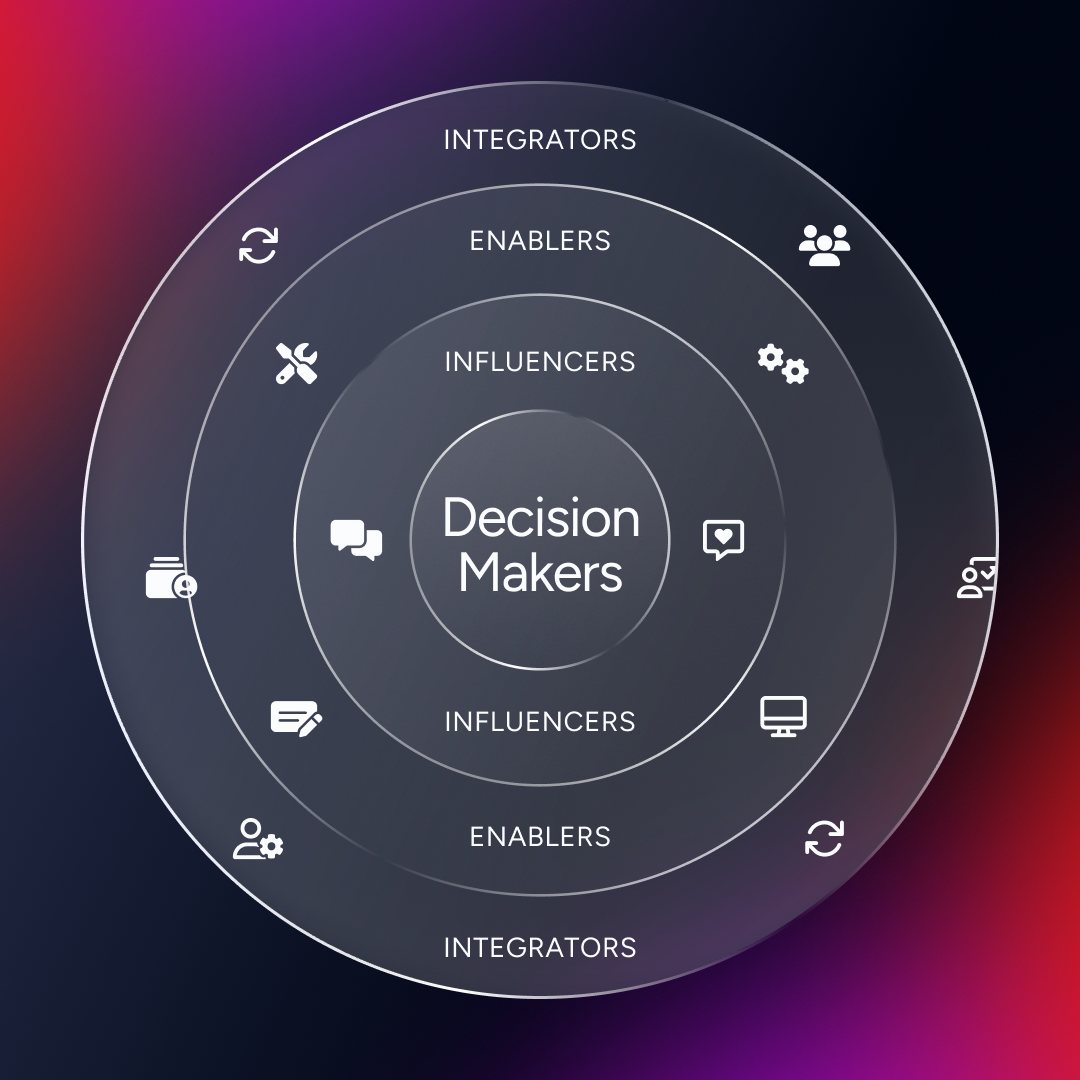

Yes, the apex decision makers matter. Think of them as the inner ring of influence, the ones who ultimately sign contracts and allocate resources. But there are multiple outer rings around them, and together they create the real power structure: the buying network.

Mapping the Rings of the Buyer Network

Here’s how to visualize the layers of a buying network:

Inner Ring: Decision Makers Directors, VPs, and executives who approve budgets and make the final call. Critical, but not the whole story.

First Outer Ring: Influencers The practitioners closest to the action. More specifically, sales and marketing operations managers, individual contributors, field marketing specialists, and GTM data analysts. They’re the ones working with your solution day-to-day and shaping how effective it really is. Ignore them, and your solution may never even reach the inner ring.

Second Outer Ring: Enablers The tech and operations experts, procurement specialists, and IT product owners. They might not “own” the buying decision, but they enable it. They ensure solutions can scale, integrate, and comply with internal requirements. If they’re not aligned, roadblocks appear quickly.

Third Outer Ring: Integrators External consultants, system implementers, and trusted advisors. Executives often lean on these voices to validate decisions and ensure initiatives succeed. If they haven’t heard of you, or worse, if they’re skeptical, your solution will struggle to gain traction.

When you engage all these rings, you’re no longer chasing a title. You’re cultivating network-wide awareness and advocacy. That’s the difference between a stalled deal and a scalable, repeatable GTM strategy.

Why Buying Networks Beat Buying Committees

Focusing only on the committee is myopic. It assumes a closed circle of authority, when in reality, B2B buying is messy, dynamic, and social. Influence flows sideways, not just upward.

Influence isn’t linear. It’s distributed. A mid-level operations manager can veto a tool that creates inefficiencies, even if a VP approves it. This is why it’s vital to engage individuals in broader rings of influence in the decision-making process; the view from the ground looks a lot different than it does from a corner office.

Executives may mandate usage of a solution, but true adoption is bottom-up. If practitioners don’t like your solution, they won’t use it. This can undermine ROI and result in lasting damage to your brand if handled poorly.

Change requires enablers. Without IT or procurement on board, your solution may stall in bureaucracy. The role of enablers becomes even more critical as solutions scale. Many organizations like to talk about “digital transformation,” but genuinely transformative initiatives risk significant disruption to everyday operations, making the support and buy-in of IT and procurement vital to larger deals and deployments.

Similarly, trust is largely external. Consultants and integrators often act as kingmakers, giving decision makers confidence to proceed, but executives also want to see proven track records, strong reputations, and measurable results. This kind of trust is hard-earned, making integrators a crucial part of the broader buying network.

Contracts are signed at the center, but won or lost at the edges.

Data: The Fuel for Buyer Network Strategy

Recognizing the buyer network is one thing. Engaging it effectively is another. This is where many GTM teams fall short: their data isn’t broad, deep, or fresh enough to cover the full network. Even if they’re confident in their data, many frontline teams attempt to secure the vital first-mover advantage by targeting senior executives right away, overlooking the often-significant network of individuals surrounding them.

Consider this:

Do you have accurate contacts for operations managers, ICs, and analysts? Or do you just have the VPs?

Do you know the procurement lead who will block your deal if they’re not educated early?

Are you refreshing data regularly to ensure turnover doesn’t erase your network map?

Too often, teams think they’ve mapped their Total Addressable Market (TAM) when in reality, they’ve only mapped the tip of the iceberg. The network is bigger. To reach it, you need a trusted, enriched, and constantly refreshed data set.

Why a Third-Party Data Partner is Essential

This is why a reliable data partner is critical. Even the most disciplined internal CRM team can’t keep up with the pace of role changes, market shifts, and organizational complexity in modern B2B.

A strong partner provides:

Coverage across all rings of the buyer network, not just the inner circle

Accuracy to avoid wasting cycles on stale or incorrect contacts

Enrichment that connects people to hierarchies, functions, and relationships

Refreshed data so your campaigns always reach the right person, at the right time

While many companies promise all this and more, it’s important to critically evaluate how potential data partners perform in your industry. Some partners may have strong visibility into financial markets, for example, but lack the expertise to provide genuine value to partners in industries such as manufacturing.

When you combine this with account-based strategies, you’re not just targeting accounts, you’re orchestrating network-wide experiences that build awareness before the decision maker ever sees your proposal.

AI and Scalability: The Next Frontier

Buyer networks are complex, and mapping them manually is impossible at scale. This is where AI becomes the multiplier.

AI can:

Identify influence pathways across networks by analyzing communication patterns and engagement data

Predict which outer ring members are most likely to influence decisions

Personalize outreach at scale, ensuring each role in the network receives relevant messaging

Continuously refine and refresh your TAM universe data based on new signals and behaviors

When paired with a robust third-party data partner, AI transforms buyer networks from an abstract concept into a scalable GTM strategy.

What This Means for GTM Practitioners

If you’re leading GTM strategy today, here’s the reality:

Stop chasing only the apex. Directors and VPs matter, but they’re not the whole picture.

Engage the rings. Influencers, enablers, and integrators can make or break your success.

Invest in data. Without an enriched, refreshed, and trusted data universe, your buyer network strategy is guesswork.

Leverage AI. Use it to scale, personalize, and predict where influence flows.

Ultimately, success in modern B2B isn’t about securing a single signature. It’s about creating a network-wide movement of awareness, trust, and advocacy that culminates in a confident “yes.”

Sell to the Network, Not Individuals

Buying committees were the old map. Buying networks are the new reality. If you want your GTM strategy to thrive, you have to see beyond the decision maker and engage the rings of influence surrounding them.

The organizations that master buyer networks, through reliable data and AI-powered scalability will not only close more deals, they’ll build stronger, longer-lasting customer relationships.

Because in B2B, you don’t just sell to a person. You sell to a network.

Thank you Ravi Sharma for the lively discussion that helped frame this article.