Businesses that are thriving in the pandemic often share a common trait: a product customers want that is simple to use and easy to access.

Looked at another way, those companies offer a customer experience that connects with buyers, whether that is web conferencing software, TV streaming services, or home cleaning products.

These days, emotional engagement with customers is a key differentiator for go-to-market teams.

The importance of building customer loyalty

Creating a bond helps retain buyers and gain repeat business. It’s also cheaper to keep an existing customer than it is to acquire a new one (think marketing campaign costs and new user training, for example).

“When most companies approach customer experience, calculating how much a customer is worth is seen as a nefarious activity — something done in a basement,” Forbes wrote. “But knowing how much your customer is worth can help you make smarter, more accurate investments in your relationships, rather than spending a lot of money everywhere.”

According to Gallup, the analytics company well known for its polls, if companies can connect with B2B customers by acting as trusted advisers, those businesses enjoy 50% higher revenue and 63% lower customer churn.

“Throughout your effort at finding and scaling your go-to-market, you need to be carefully studying your customers’ experience with the product.”

— Matt Munson, CEO coach and angel investor

“Throughout your effort at finding and scaling your go-to-market, you need to be carefully studying your customers’ experience with the product,” wrote CEO coach and angel investor Matt Munson. “Are they sticking around? If they aren’t, halt all growth efforts and go figure out why. If they are happy, ask them for quotes and case studies and use these as early collateral for your sales team.”

Online Searches May Indicate Early Go-to-Market Motions

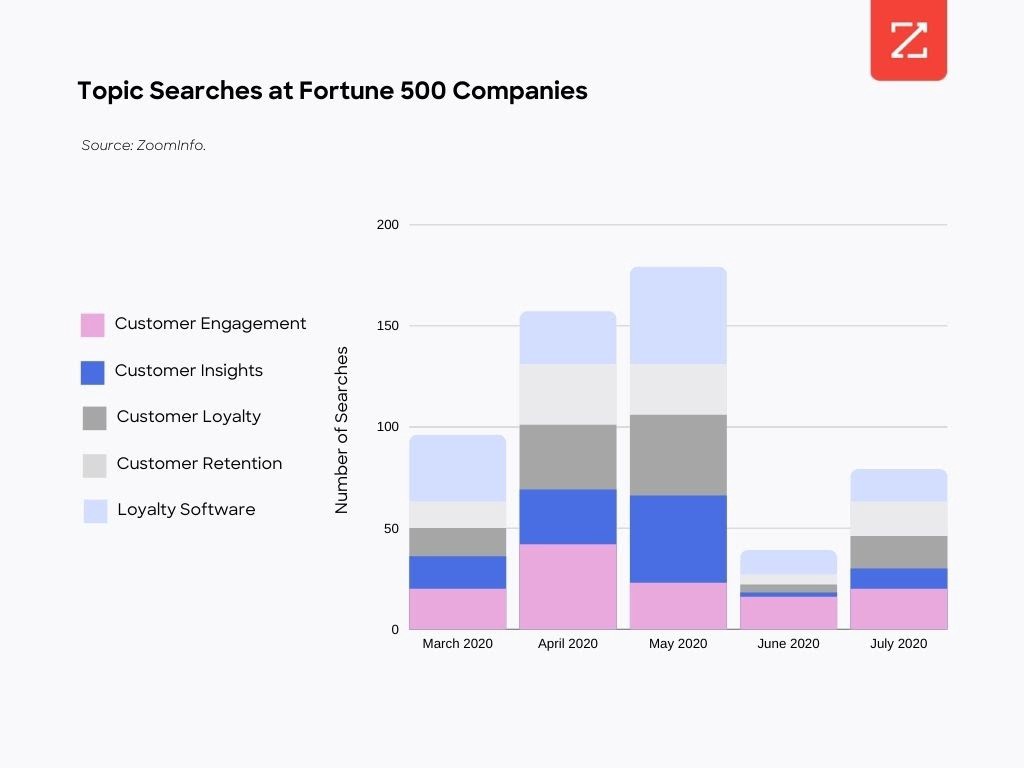

ZoomInfo analyzed recent web searches conducted by Fortune 500 companies on 10 topics that might indicate an early interest in building loyalty, potentially as part of go-to-market plans.

For seven out of the 10 topics, there was a peak in interest in April or May 2020, followed by a drop in June, and then a smaller upswing in July. Those seven topics included:

Content personalization

Customer engagement

Customer loyalty

Loyalty software

Net Promoter Score

The patterns for these topics are consistent enough to suggest that interest in customer experience and loyalty rose in the spring because of business concerns centered on the early stages of the pandemic, when much of the economy slowed down.

For three other topics — customer attrition (same as customer churn), customer lifetime value, and user experience — recent interest spiked in June and July 2020.

So what do these patterns mean in the bigger picture? Employees at nearly 10% of Fortune 500 companies searched for at least one loyalty-based topic from March to July 2020, pointing to possible go-to-market motions at these high-earning U.S. firms.

Pandemic Spurs Customer Experience Interest on Both Sides

Various signals indicate that during a crisis, such as a pandemic, customer experience receives heightened urgency from buyers.

Meanwhile, almost 10% of the top-earning companies in the U.S. have searched for loyalty-related topics online since March 2020 — a sign that new or expanded go-to-market efforts may be bubbling at those firms in response to COVID-19.

Seeking out and capitalizing on customer engagement should be high on the to-do list of any company looking at go-to-market initiatives in 2020 into 2021.