The importance of data is undeniable. But the path to reliable business intelligence is not always straightforward. When you set out to buy a third-party data set, you might assume you should compare based on quantity and cost. But using evaluations like "how many accounts can you provide?" or "what is your cost per contact?" often means the vendor with the most records wins and the one offering the highest quality data gets overlooked.

The dynamic nature of business requires an equally dynamic solution for acquiring and managing data. Teams that are purchasing data should look for a provider who can deliver accurate, current, and reliable data across an entire organization and help manage it in real-time.

Here are the important factors to consider, steps to take, and questions to ask when choosing a global data provider.

What Is B2B Data?

B2B data is verified business intelligence about companies and their employees. When evaluating a B2B data purchase, you're acquiring contact information (emails, phone numbers), firmographic details (company size, revenue, industry), technographic insights (software stack, tools in use), and intent signals (buying behavior, research activity). This intelligence powers sales prospecting, account-based marketing, and revenue operations across mid-market and enterprise GTM teams.

B2B data comes from multiple sources:

First-party data: Information collected directly from your customers and prospects through forms, CRM records, and website interactions.

Third-party data: Business intelligence purchased from external data vendors to expand your reach beyond existing contacts.

What makes B2B data valuable are three key characteristics:

Actionable: Enables direct outreach with verified contact details.

Current: Reflects real-time business changes as people switch roles and companies evolve.

Comprehensive: Covers contacts, companies, and buying signals in one unified view.

Why B2B Data Matters for Revenue Teams

Revenue teams rely on accurate data to reduce prospecting time, improve targeting precision, and increase conversion rates. Bad data leads to wasted effort, missed quotas, and damaged sender reputation. Good data multiplies sales and marketing productivity.

The consequences of bad data versus the benefits of good data:

Bad data creates measurable drag on revenue teams:

Sales reps waste hours researching outdated contacts

Email bounces damage sender reputation and deliverability

Marketing campaigns miss target accounts entirely

Good data multiplies GTM efficiency:

SDRs connect with decision-makers on the first attempt

Email campaigns maintain 95%+ deliverability rates

Marketing budgets reach accounts showing active buying intent

THE VALUE OF GOOD DATA

You have lofty growth goals, but you can't always hire new team members to reach them. Consider the average annual salary of a Sales Development Representative (SDR). Now imagine making them three to four times more effective, because they spend their time making connections and engaging prospects, instead of researching contacts and hunting through business articles. That's the value of good data.

Types of B2B Data

B2B data purchases typically include four core data types. Each serves a distinct purpose in your go-to-market strategy.

Data Type | What It Includes | Primary Use Case |

|---|---|---|

Contact Data | Names, titles, emails, phone numbers | Outbound prospecting and direct engagement |

Firmographic Data | Company size, industry, revenue, location | ICP definition and account segmentation |

Technographic Data | Technology stack, software usage, IT vendors | Competitive displacement and solution fit |

Intent Data | Buying signals, topic research, job postings | Account prioritization and timing |

Contact Data

Contact data is information about individual professionals. It's the foundation of outbound prospecting and enables direct engagement with decision-makers.

Typical contact data fields include:

Name

Job title

Email addresses

Direct-dial phone numbers

Mobile numbers

Department

Physical location

Social media profiles

Firmographic Data

Firmographics are company-level attributes. They enable ICP definition and account segmentation for targeted campaigns.

Typical firmographic fields include:

Company name

Industry classification

Employee count

Annual revenue

Headquarters location

Parent-child relationships (corporate hierarchy)

Physical locations

Website URL

Technographic Data

Technographics are information about a company's technology stack. They help identify prospects based on competitive displacement opportunities or complementary technology fit.

Example technographic signals include:

CRM system: Salesforce, HubSpot, Microsoft Dynamics

Marketing automation: Marketo, Marketing Cloud Account Engagement (formerly Pardot), Eloqua

Cloud provider: AWS, Azure, Google Cloud

Communication tools: Slack, Microsoft Teams, Zoom

Intent Data and Buying Signals

Intent data is behavioral signals indicating a company or contact is actively researching topics related to your solution. It helps prioritize accounts showing active buying behavior over static lists.

Examples of intent signals include:

Topic Surge: Company researching "CRM migration" or "sales intelligence tools"

Hiring Signals: New VP of Sales or Revenue Operations Manager posted

Funding Events: Series B announcement or acquisition news

Leadership Changes: New executive appointments in target departments

Market News: Company expansion, new product launches, or market entry

Why GTM Teams Buy B2B Data

Go-to-market teams buy B2B data to power specific revenue motions. Understanding your use case shapes which data attributes matter most.

Common use cases that drive B2B data purchases:

Use Case | Primary Team | Data Requirements |

|---|---|---|

Pipeline Creation | SDR/BDR | High volume of verified phone numbers and emails |

Account-Based Marketing | Marketing | Firmographics and technographics for targeting |

TAM Analysis | Revenue Operations | Comprehensive company data for market sizing |

CRM Enrichment | Operations | Field append and deduplication capabilities |

Competitive Displacement | Sales | Technographic data showing competitor tool usage |

Match your B2B data purchase to your specific revenue goals:

High-volume calling: Verify the provider offers sufficient direct-dial phone numbers to support daily activity targets

Email deliverability: Confirm the provider can help maintain 1-5% bounce rates through verification and hygiene

Multi-source integration: Select a provider that unifies data sets correctly across your tech stack

CRM enrichment: Understand the provider's match rate and fill rate for your priority fields

SMB coverage: Ensure the provider has depth in small business contacts, not just enterprise accounts

Attribute specificity: Confirm the provider delivers key attributes (revenue, industry classification, sophistication rating) with high confidence scores

How to Evaluate B2B Data Quality

Data quality is measured by how effectively it drives your revenue outcomes, not by cost or record count alone.

Cost matters when evaluating a B2B data purchase, but price and value don't always align. Budget providers often sacrifice accuracy for volume.

Sales teams seek balance between three factors:

Quantity: Breadth of coverage across your target accounts

Quality: Accuracy of contact details and company attributes

Cost: Total investment relative to expected ROI

These factors often conflict. Niche providers deliver narrow but deep coverage. Volume providers offer broad records at lower accuracy. Understanding this trade-off shapes your B2B data purchase strategy.

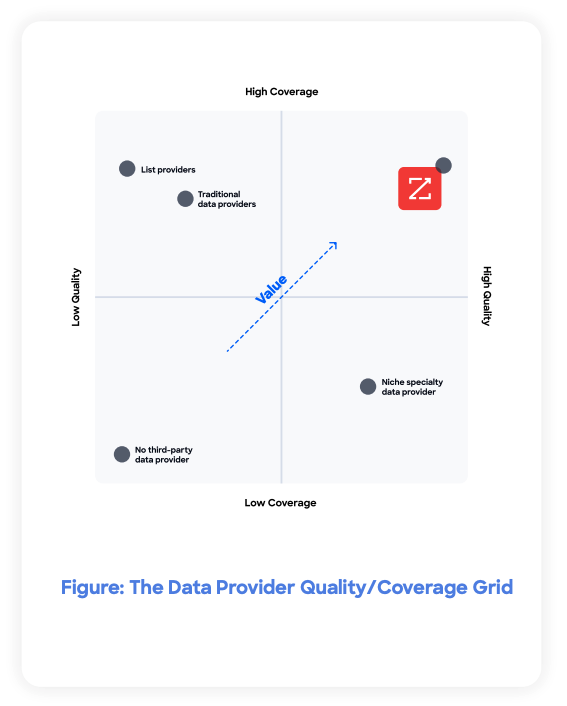

The following grid shows this quality vs. quantity trade-off:

The Data Provider Quality/Coverage Grid

It's important to consider both quality and coverage when evaluating a data provider. Since every company has different goals, each will have a unique path for getting the most value from business data. One company's tolerance for data quality will differ from another based on various factors, including the solution sold, the markets served, and the level of granularity required.

When in doubt, we recommend prioritizing quality over quantity. We have developed a "data reliability" formula to help assess the quality of data: Match Rate multiplied by Fill Rate multiplied by Accuracy or Confidence Scores.

The Formula for Calculating Data Reliability

In this data reliability formula:

Match Rate (%): The portion of records matched

Fill Rate (%): The portion of fields containing data

Match Confidence (#): The level of certainty the match is correct

Fill Confidence (#): The level of certainty the filled information is correct

Accuracy and Verification

Accuracy means the information is correct. A contact's email address actually reaches them. A phone number connects to the right person. A company's revenue figure reflects current reality.

How to measure accuracy:

Email bounce rate: Industry standard is 1-5% for quality data. Higher rates indicate stale or unverified contacts.

Connect rate: For phone numbers, what percentage result in actual conversations with the intended contact?

Data freshness: When was the record last verified or updated?

Questions to ask vendors about verification:

How do you gather and verify data? A reputable data company should be able to tell you details about how they capture information.

How do you measure how trustworthy your data is? Find out if they have the most current information possible. Ask how they measure the completeness and correctness of the data being offered.

Can you share some recommendations for using data based on my goals? For example, ask how the provider can help you get the highest email deliverability from your campaigns.

THE VALUE OF GOOD DATA

Prioritize quality over quantity for your critical data attributes. If your business runs on phone outreach, accurate direct-dials matter more than comprehensive physical addresses. High email bounce rates destroy sender reputation, while verified contacts keep your team connected to real buyers. That's the value of good data.

Coverage and Depth

Coverage is the breadth of records. How many companies does the provider track? How many contacts per account? Depth is attribute completeness. How many fields are populated per record?

When considering "coverage vs. quantity," coverage indicates records that are actionable, active, and verified. Quantity is a numbers game that often includes inactive or duplicate entries.

To evaluate the potential quality of a dataset, compare the provider's record count against government census or population reports. If numbers are inflated beyond what's accounted for, it's a warning sign of outdated records or duplicate contacts for the same role.

Key distinctions between coverage and quantity:

Coverage: Verified, active contacts with complete field data across your target market

Quantity: Total record count, which may include inactive, duplicate, or incomplete entries

Freshness and Refresh Cadence

Business data decays rapidly. People change jobs, companies merge, and contact information becomes obsolete. In 2026, the workforce continues to experience high turnover across industries.

Job mobility and company restructuring create constant data churn. When one person changes roles, two contact records are affected: the departing employee and their incoming replacement. This makes continuous data refresh critical for accurate B2B data purchases.

Company transformations accelerate data decay across your B2B data purchase:

Job changes: When one person switches roles, two records need updating (departing employee and their replacement)

New businesses: Company launches trigger hiring waves and new contact creation

M&A activity: Mergers and acquisitions reshape org charts and change employee responsibilities

Questions to ask about data freshness:

How often is your data refreshed and how do I know when something changes? Business data is prone to frequent changes. To get the most out of sales and marketing intelligence, it's got to be up-to-date. Beyond data being current, it may also be important to be alerted of what's changed in real-time when it happens.

What is your data refresh cadence? Daily, weekly, monthly?

Do you provide alerts when key contacts change roles or companies?

Compliance and Privacy in B2B Data

Compliance is a buying criterion, not just a legal checkbox. Data sourced without proper consent or in violation of privacy regulations puts your company at risk. Fines, lawsuits, and reputational damage follow non-compliant data practices.

Key regulations that govern B2B data:

GDPR (General Data Protection Regulation): European Union regulation requiring consent for data collection and processing

CCPA (California Consumer Privacy Act): California law giving consumers control over their personal information

Do Not Call (DNC) lists: Federal and state registries restricting telemarketing calls

Privacy measures to evaluate when purchasing B2B data:

Consolidated customer data platform as much as possible

Proactive notifications, alerts, based on local jurisdictions and laws

Encrypt data at rest and in-flight

Easy 'Opt-out' option

Employ a 'Do Not Call' field

Able to monitor how data is being used (B2B vs. B2C)

Trusted in my target market(s)

Reliable language translation

Questions to ask vendors about compliance:

What are your privacy practices? Ask the vendor what resources they can share with you to help maintain compliance. This is especially true if you are prospecting into a market for the first time. If a data provider has spent a considerable amount of time and energy on compliance, you are likely to find their data meets the same rigor.

How do you source data in GDPR-compliant regions?

Do you maintain DNC list suppression?

Can you provide audit trails for data sourcing?

Platform-Led Data vs. Static Lists

Purchasing a list of business data typically involves a static file with a large number of records for a low price. But it's important to note that a list of data gets worse over time. It's estimated that company and contact data degrades at a rate of 2 to 3% each month, or 30% year-over-year. And that number is likely much higher in the aftermath of COVID-19.

To counter this rate of data decay, smart leaders are turning to data orchestration platforms. A well-orchestrated data solution allows you to enrich, cleanse, and unify records for companies and contacts, generate insights, route data where you need it, and maintain a standard of quality, coverage, and compliance. Also, by automating much of the manual data-related tasks, good data management frees up teams to focus on high-value, strategic initiatives, and prospecting.

Evaluation Factor | Static Lists | Platform-Led Data |

|---|---|---|

Freshness | Degrades 2-3% monthly; stale within weeks | Continuous updates; real-time refresh |

Compliance | No ongoing opt-out management; risk exposure | Automated DNC suppression; consent tracking |

Integration | Manual CSV uploads; one-time import | Native CRM sync; automated enrichment |

Cost Structure | Low upfront cost; high hidden cost (wasted effort) | Subscription model; predictable ROI |

THE VALUE OF GOOD DATA

Forrester states in its Data Ethics and Technology Report that, "the quality of business decisions you make using data will depend on the integrity of the data." If you build your business on bad data, bad things are bound to happen. But when you feed predictive business models with quality information, you know the output is trustworthy. That's the value of good data.

How to Choose the Right B2B Data Provider

Choosing a B2B data provider requires evaluating more than just data quality. Integration capabilities, workflow activation, and ongoing support determine whether the data actually gets used by your teams.

Consider how the data will activate your go-to-market motions:

CRM Integration: Does the provider offer native integrations with Salesforce, HubSpot, or your CRM of choice?

Workflow Activation: Can you trigger enrichment automatically when new leads enter your system?

API Access: Do you have programmatic access to data for custom workflows?

Leading B2B data providers like ZoomInfo, Apollo, Cognism, and LinkedIn Sales Navigator offer different strengths. ZoomInfo combines comprehensive contact and company data with native CRM integrations and AI-powered workflow automation through GTM Workspace.

Key Questions to Ask During Evaluation

When evaluating data providers, ask the following questions to uncover more details about what you'll get:

Data Quality Questions:

How do you measure how trustworthy your data is? Find out if they have the most current information possible. Ask how they measure the completeness and correctness of the data being offered.

How do you gather and verify data? A reputable data company should be able to tell you details about how they capture information. Be ready to ask questions when you hear terms like artificial intelligence, algorithms, proprietary processes, or search aggregation.

How often is your data refreshed and how do I know when something changes? Business data is prone to frequent changes. To get the most out of sales and marketing intelligence, it's got to be up-to-date. Beyond data being current, it may also be important to be alerted of what's changed in real-time when it happens.

Integration Questions:

What types of integrations do you offer? What tools will be available on a regular basis? While many vendors offer integration, the capabilities are not often the same. For example, the ZoomInfo integration allows you to map and set individual fields to "Complete if Missing" or "Overwrite Data." This gives you control over which information goes where and at what time. You may not need that much control over the integration process, but if you do, ask.

How can I ingest your data? The ability to onboard data in a systematic, efficient way is critical for your company to expand its reach in the market. Make sure the data vendor offers customizable ways to enrich data directly into your tech stack and standardize data across multiple sources.

Compliance Questions:

What are your privacy practices? Ask the vendor what resources they can share with you to help maintain compliance. This is especially true if you are prospecting into a market for the first time. If a data provider has spent a considerable amount of time and energy on compliance, you are likely to find their data meets the same rigor.

Pricing Questions:

Why is your data priced as it is? The pricing offered by a data provider can often give hints about how trustworthy their data will be. This is not to say you should always buy the most expensive option, but rather, consider the cost as a measure of value. You may have the tolerance to deal with low-quality data. If that is the case, perhaps a low-cost tool is the best option for you.

At ZoomInfo, we've built the world's best B2B data and intelligence platform to support your go-to-market strategy. Access the data you need to expand your business around the globe.

Talk to our team to learn how ZoomInfo can power your revenue operations.

FAQs About Purchasing B2B Data

What Is B2B Data?

B2B data is verified business intelligence about companies and employees, including contact details, firmographics, technographics, and buying signals that power sales and marketing outreach.

Why Do Companies Buy B2B Data?

Companies buy B2B data to reduce prospecting time, improve targeting accuracy, and accelerate pipeline creation with verified decision-maker contacts.

How Do You Evaluate B2B Data Quality?

Evaluate B2B data quality using match rate, fill rate, and accuracy scores before committing to a purchase.

What Should a B2B Data Provider Include?

A complete B2B data provider includes verified contacts, firmographic and technographic intelligence, CRM integrations, and continuous data refresh.