Layering various customer buying signals on top of each other is a reliable, data-based approach to predict when a prospect is facing a business challenge that your product can solve.

By adding automation to these high-quality results, day-to-day sales and marketing efforts get easier, too.

Savvy sales reps and marketers can take this approach to engage with leads earlier and stay ahead of their competitors. Let’s take a quick look at how the ZoomInfo platform offers features to achieve this success.

Buying Intent Reveal Interests

Buying signals in their various forms uncover patterns and interests that indicate a company is researching a product purchase. These data points flesh out ideal prospects that you can target.

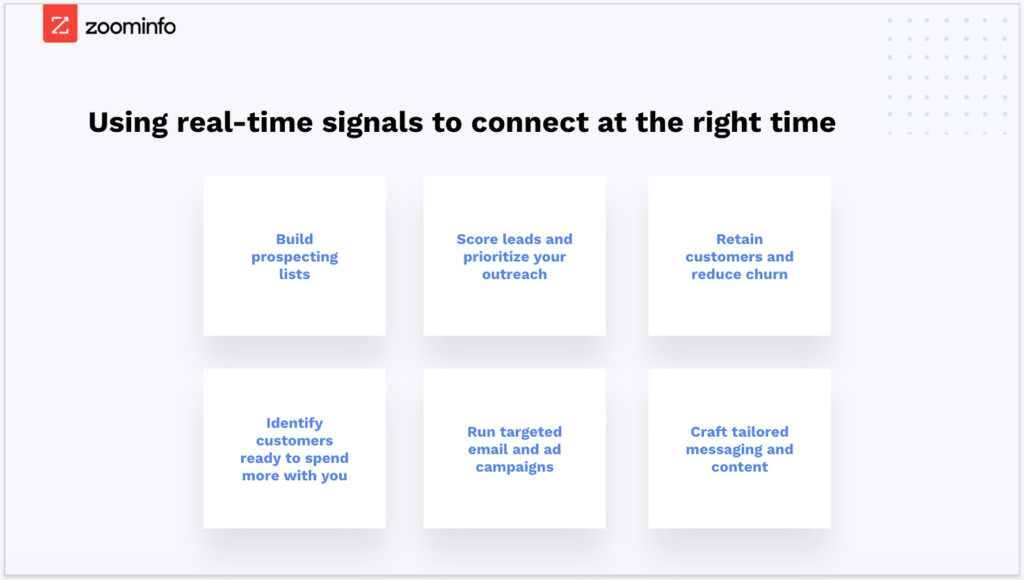

“You can craft tailored messaging and content that’s going to resonate and help you connect with folks,” Sophia Chang, product marketing manager at ZoomInfo, said during a recent webinar, “Leveraging Real-Time Intent and Signals as a Secret Weapon.”

The advantage of using buying signals is simple: It saves teams time by narrowing down the pool of prospective leads, and it also saves money by focusing spending on top-notch, in-market prospects.

Three Kinds of Signals to Help You Prioritize Outreach

ZoomInfo offers three tools in its platform that show different types of buying signals:

In the case of WebSights and Streaming Intent, they do not identify individuals, but ZoomInfo’s contact database can point marketers to relevant contacts in their buying committee.

When you layer all these buying signals on top of each other, the results can help prioritize outreach efforts to prospects. Sales and marketing teams can use this information to send targeted campaigns to people at these companies.

Example: Manufacturer Researching Supply Chain Software

Here’s a brief example that shows how this layering works.

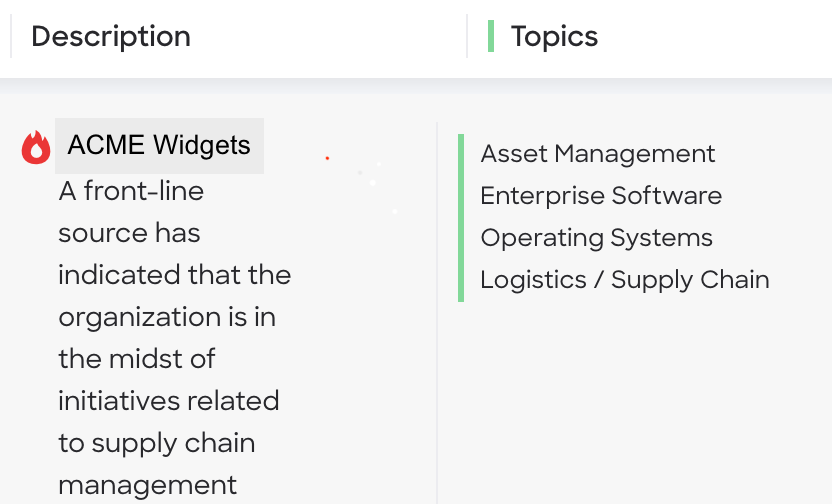

Suppose a mid-market manufacturer has encountered problems with its supply chain over the past year. Several managers at the manufacturing firm have begun researching new supply chain management software, and your company is a provider of this service.

Two of the managers at the manufacturing firm have visited your company’s online pricing page, so WebSights shows this firm’s activity for that page. Once you have that information, a follow-up approach is to tag these companies in the ZoomInfo platform.

“You can think of tags as digital sticky notes within the ZoomInfo system,” Anderson Campbell, learning and development manager at ZoomInfo, said during the webinar.

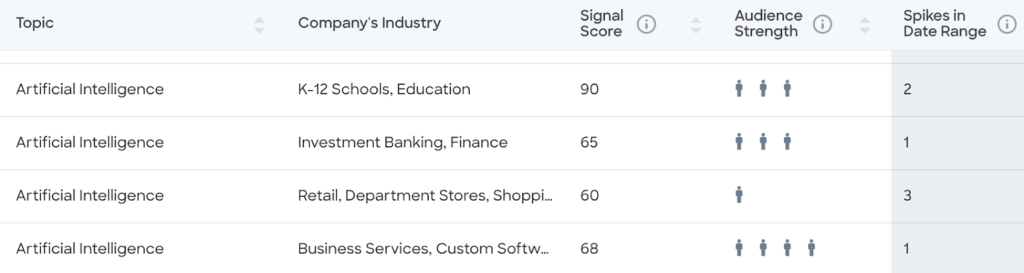

Other employees at the manufacturer have read online content that is about “supply chain software” and “supply chain management” — two topics your company tracks using Streaming Intent. When there’s an above-average amount of online research on a specific topic, the ZoomInfo platform indicates a spike in this research — and with Streaming Intent, you can get these updates as soon as more research is being done.

Using standard filters on the ZoomInfo platform, a team can filter the Streaming Intent results with accounts that are tagged. The subsequent list shows companies that have visited your pricing page (WebSights) and shown elevated interest in supply chain software (Streaming Intent). Many other filters, such as company headquarters location, industry, or technologies installed, are also available.

“Any time you find a good set of filters that works for you and gets you that exact right list … save all of those filter criteria and set up an alert so that we can automate some of this for you and send you either a daily or weekly email with new companies that fit this criteria,” Campbell said.

Finally, according to Scoops, a mid-level source in the manufacturer’s IT department has reported a new project to purchase supply chain software. A previously-set-up alert is automatically sent to sales based on the intel because the firm is already on the list of tagged prospects mentioned earlier.

Buyer Intent Keep Marketers Ahead

Combining the B2B intelligence unearthed by WebSights, Streaming Intent, and Scoops — and then automating sales and marketing actions based on that intel — narrows the time needed to add a prospect to a campaign. This quick action potentially puts your company ahead of competitors in reaching a prospect first.

Additionally, teams also save money with this approach by directing resources to high-quality prospects rather than blanketing a bunch of would-be leads.

Don’t rely on just one type of data for modern outreach efforts. Instead, layer several sources on top of each other to draw a clearer picture of active prospects that have true interest in your product.