Every few months, B2B go-to-market (GTM) practitioners make bold declarations about the state of the industry.

"SDRs are irrelevant." "Outbound is dead." "Inbound is broken."

This might make for enticing social content, but in B2B, nothing really dies. It evolves. Even the most advanced GTM motions are built on the foundation of conventional methods of the past.

Just as today’s markets change rapidly, outbound sales motions must adapt and change just as quickly. But rapid change alone isn’t enough. To truly succeed and achieve strong, sustainable growth, today’s B2B businesses need to execute that change with decisive intent, strategic alignment, and clarity of purpose.

The Disruption of Inbound B2B

If you've felt the sting of generative AI search, AI Overviews, or Generative Engine Optimization (GEO) on your inbound motion, you're not alone.

Across the industry, companies are reporting declines in web traffic of between 30-40% as AI reshapes SEO practically overnight. Gartner predicts traditional search traffic as a whole will drop by 25% by 2026 as AI answers replace traditional clickthroughs. In March 2025, Bain reported decreases in clickthrough rates of 30% across B2B, a trend that seems likely to continue.

The playbook that worked even a year ago suddenly feels unreliable, and many businesses are scrambling to respond to this rapidly changing paradigm. But while inbound is experiencing profound disruption, outbound has quietly been transforming in parallel, becoming more sophisticated, data-driven, and effective than ever before.

Intelligent Outbound: The Data-AI Convergence

The outbound of the past focused on cold calls and raw volume. By contrast, intelligent outbound focuses on precision targeting powered by three key pillars.

1. Predictive account scoring

The breakthrough comes from combining first- and third-party data to predict buying cycles. At ZoomInfo, we use a weighted scoring model that tracks:

Technographic changes such as new tool implementations and contract renewals

Hiring patterns like job posts for roles that indicate growth and change initiatives

Digital engagement including content consumption, competitor research, and pricing page visits

Search engine data and signals including keyword research patterns, search volume spikes, and long-tail queries

Financial triggers such as funding rounds, leadership changes, and earnings calls

2. Buying group mapping

Instead of targeting single contacts, we identify entire buying committees early. For a typical enterprise deal, this typically means engaging 6-8 key stakeholders across the C-suite, GTM, Operations, Finance, and IT, each with contextualized messaging based on their role and research behavior.

3. Intent-driven messaging

When someone researches "sales productivity tools" vs. "CRM integration challenges," those searches represent different buying stages that require distinctly different approaches. Our messaging framework maps intent signals to specific use cases, problems, and solutions.

How We Apply The Intelligent Outbound Framework at ZoomInfo

Here's our intelligent outbound playbook in action.

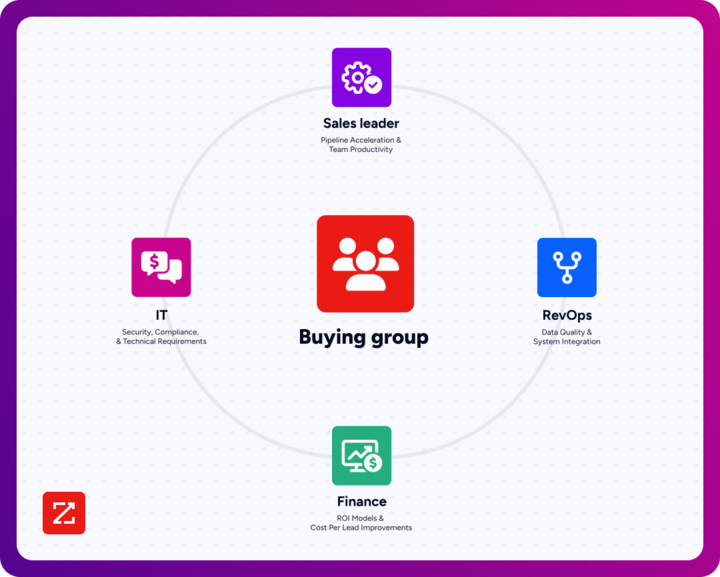

When we detect an account showing intent for "sales intelligence" combined with recent RevOps hiring and Salesforce expansion, we don't just call the VP of Sales. We orchestrate touches across the buying group:

Sales Leader: Focus on pipeline acceleration and team productivity

RevOps: Emphasize data quality and system integration

IT: Address security, compliance, and technical requirements

Finance: Highlight ROI models and cost-per-lead improvements

Our sequences deliver 3X higher response rates than generic outreach because every message connects to demonstrated interest and role-specific pain points.

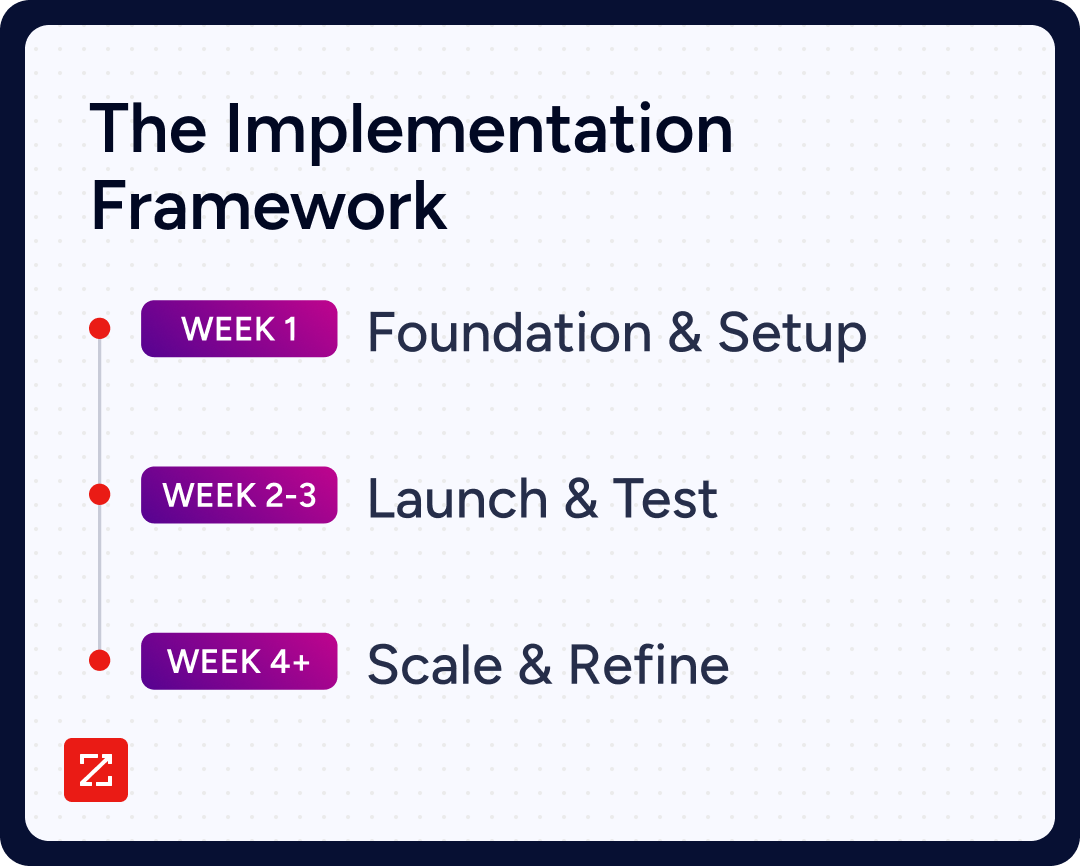

The Implementation Framework

The gap between understanding intelligent outbound and executing it is where most companies stumble.

Here's a proven 30-day implementation plan your teams can implement that removes the guesswork and provides a replicable, adaptable strategy for sustained growth.

Week 1: Foundation and setup

Start by conducting a comprehensive audit of your current account scoring methodology. Most companies discover their existing criteria focus heavily on firmographics while ignoring behavioral signals that actually predict buying readiness. Prioritize scores that favor first-party engagement from members of the buying group.

Integrate your CRM data with third-party intent platforms to create a unified scoring engine. Such a scoring model might weigh intent signals at 40%, technographic fit at 30%, timing indicators at 20%, and firmographic alignment at 10%, for example.

Next, map your buyer personas beyond basic demographics to align with established ideal customer profiles (ICPs). Document how different roles research solutions, their typical objections, and their influence on purchasing decisions.

Create standardized buying group templates. We’ve found that startup buying committees typically involve 3-4 individuals, midmarket companies require 5-6 stakeholders, while enterprise deals demand engagement with 7-8 decision makers across multiple departments, if not more.

Weeks 2-3: Launch and test

Begin with your highest-scoring 50 accounts to validate your messaging framework. Develop role-specific email templates that reference specific intent signals. These templates should incorporate first-party data such as web engagement and previous call recordings whenever possible, and be contextualized with third-party account-level data.

Deploy sequences across multiple channels with strategic timing that aligns with peak engagement trends. Emails should be concise, timely, and contextualized. As well as tracking open and response rates, monitor progression metrics, such as which messages drive prospects to visit your pricing page or requests for demos.

Run concurrent A/B tests on subject lines, personalization depth, and call-to-action positioning. Test problem-focused subject lines against solution-focused ones to determine which messaging resonates with each buyer persona.

Week 4+: Scale and refine

Establish weekly account scoring reviews in which you analyze which signals most accurately predicted conversions. Depending on the results, adjust weighting accordingly. Companies often discover that hiring patterns are more predictive than web activity, or that technographic changes outweigh funding announcements.

Implement monthly message optimization cycles based on performance data. If there are significant disparities in response rates across separate industries, investigate whether specific value propositions align with each role's priorities. Quarterly model refinements should incorporate win/loss interview insights to continuously improve buyer persona accuracy and scoring precision.

Scale successful frameworks to your next 200 highest-scoring accounts. It’s important, however, to resist the temptation to expand too quickly. Maintain quality over quantity. It’s better to perfectly execute outreach to 250 accounts than poorly target 1,000.

The Path Forward for Outbound B2B

Companies implementing this approach report 40-60% increases in qualified opportunities and 25% shorter sales cycles.

The data is clear: while inbound continues to evolve, outbound is experiencing its most sophisticated era yet.

If your pipeline has taken a hit from declining search performance, the answer isn't to cling to outdated models. It's to embrace the outbound renaissance, where AI, data, and intent signals converge to drive meaningful engagement at scale.

Outbound isn't dead. By leveraging this proven framework, it may prove to be your most reliable growth engine in today's AI-driven B2B markets.