You may have seen the TV ads that show the United States largely enveloped in pink.

The color illustrates the phone coverage for T-Mobile, which acquired rival Sprint in April. The map shows the literal market expansion T-Mobile achieved from the purchase.

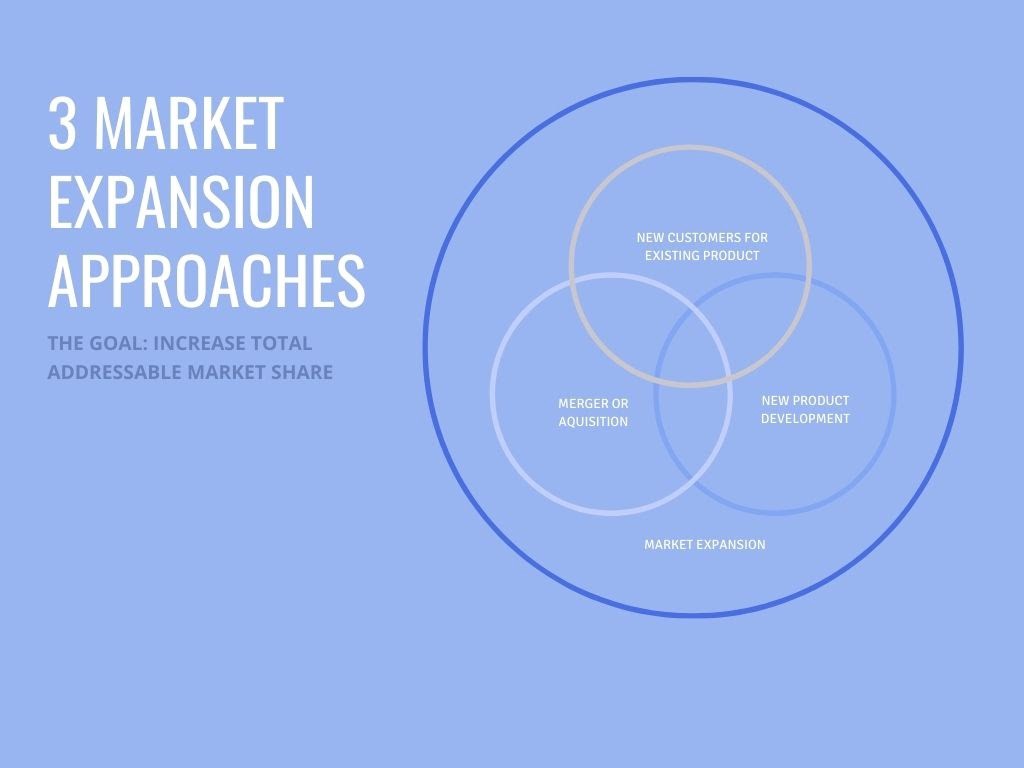

A core piece of expansion is the idea of increasing a seller’s total addressable market. This concept represents the full amount of companies or consumers that could become customers or the total revenue possible for a product to generate.

Increasing a company’s reach has long-term implications for finding new customers and creating greater visibility — and even stability — for products.

Factors to consider when evaluating expansion potential

Harvard Business Review outlined a matrix to evaluate new markets for possible expansion. Briefly, the matrix ranks three metrics:

The size of a new market compared to other markets.

How a company already performs in a new market.

The ease or difficulty in addressing customers’ needs in a new market.

Higher-scoring metrics indicate better opportunities for a company.

“The main value of [this] model is that it forces you to look closely at how you would perform in each market, one at a time, at the micro level,” Nataly Kelly, vice president of localization at HubSpot, wrote in the article. “Instead of thinking in generalities across entire regions or group of countries, it helps you to understand your company’s weaknesses and opportunities in each local market.”

Breaking into a new market can increase revenues while also building a company’s recognition and reputation. Meanwhile, buyers who are not familiar with products or services can benefit from market expansion as a company increases its reach.

Three typical market expansion approaches include the following:

Expansion through a merger or acquisition.

Expansion by finding new customers for an existing product.

Expansion by developing a new product.

Each of them features nuances, but they share the end goal of increasing the total addressable market. Let’s explore some examples.

Expansion through a merger or acquisition

When M&A occurs, it creates an opportunity for the parent firm to slide into markets that a newly acquired company occupies. T-Mobile saw this opportunity with the aforementioned Sprint purchase.

“We’re bringing competition into the market,” Mike Sievert, T-Mobile’s CEO, said during an earnings call in August.

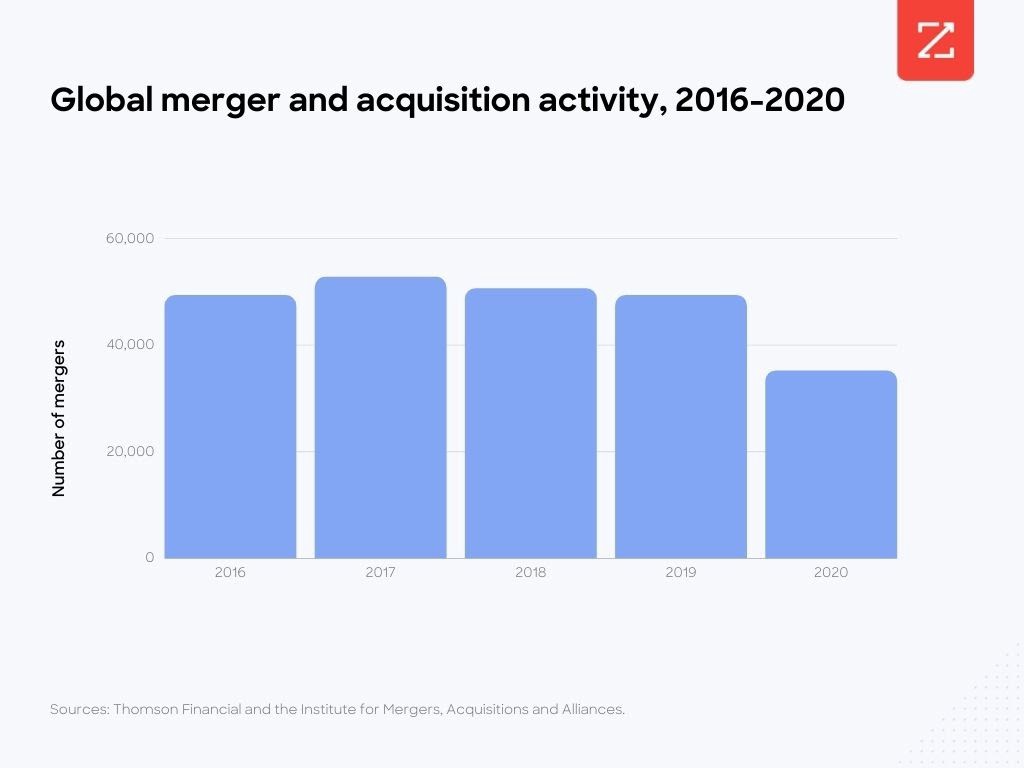

Conversely, far fewer acquisitions occurred in 2020 than in the four prior years, according to statistics and analysis from Thomson Financial and the Institute for Mergers, Acquisitions and Alliances.

The dip — a 29% drop from 2019 to 2020 — stems from the pandemic and damaged economy. That said, more than 35,000 companies this year still expanded their markets through this avenue.

Lululemon — a sports apparel retailer — was one of those firms, as it bought in-home fitness startup Mirror for $500 million in June 2020. Mirror, a rival of Peloton, sells a device that streams workout classes while allowing users to see their reflection.

The acquisition brought Lululemon into the realm of at-home workout enthusiasts — one that grew during COVID-19 lockdowns.

“It’s not an acquisition simply to sell more apparel,” Lululemon CEO Calvin McDonald told CNBC. “We think that will be a byproduct.”

Meanwhile, Vocera — which develops secure communications devices for healthcare professionals — bought EASE in August 2020 as a way into the patient-facing market. EASE sells a cloud-based communication platform and mobile app that lets families receive updates about the progress of loved ones in the hospital.

The acquisition offers cross-selling opportunities and increases the total addressable market, according Brent Lang, Vocera’s CEO.

“Bringing this tool into the fold allows Vocera to offer a broader range of communications tools to its provider customers — especially in light of the patient satisfaction benefits [EASE] touts on its website,” reported MobiHealthNews.

Expansion by finding new customers for an existing product

In this scenario, a company further penetrates its customer base by marching into a new vertical market either in a region or through global expansion.

Transcat, a manufacturer of calibration instruments, offers a good example of this approach. In 2020, the company continued to push into the life sciences field with its products. It already has a foothold in the industrial manufacturing and chemical processing industries.

Sometimes new customers can overwhelm a company when the expansion is not predicted.

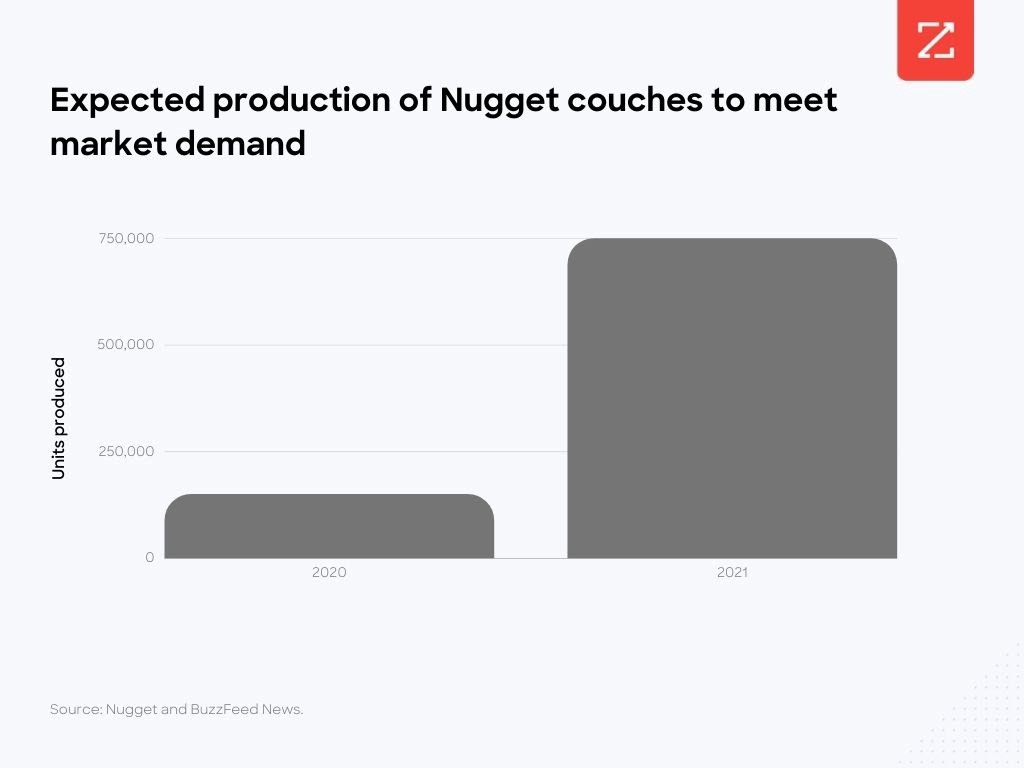

Take Nugget, for example, a modular-foam couch that resembles a futon with separate cushion pieces. The founders were college students and envisioned the $250 product for dorms rooms — until moms started buying Nuggets for their kids to play on and word spread like a hurricane across social media.

CEO David Baron told BuzzFeed News that the company had just finished shipping out back orders from Christmas 2019 when the pandemic hit the U.S. That setback further slowed the needed supply to meet the unexpected demand for Nugget, which caught the founders off guard.

“It was a failure of our imagination,” Baron said.

Nugget hopes to ship 150,000 couches by the end of 2020, and plans to increase production to make 750,000 in 2021, BuzzFeed noted.

Expansion by developing a new product

Under this scenario, a firm develops a feature or product that appeals to buyers who were not a focus previously.

One company in the midst of this work is RealNetworks, which creates facial recognition technology for commercial customers — and now will expand its product line to military bases. In August 2020, an innovation group in the U.S. Air Force awarded two contracts to RealNetworks to adapt an existing platform for use by the Air Force for perimeter security.

“The total value of [these] contracts is almost $2 million,” CEO Robert Glaser said during an earnings call in August. The project “will advance the capabilities of our commercial platform for militaries.”

Market expansion leads to executive hiring

Companies in the midst of market expansion often look to their own organizational charts to bolster leadership in needed areas.

Two of the companies mentioned earlier — Transcat and RealNetworks — appointed new vice presidents in 2020 whose roles are to increase market penetration.

Go-to-market efforts with expansion benefit from new sales and marketing leaders, CEO Brad Birnbaum said in a 2018 episode of the SaaStr Podcast.

Birnbaum co-founded and leads Kustomer, a customer service platform which announced in November 2020 that it will be acquired by Facebook as part of the social media giant’s own market expansion strategy.

When Birnbaum started Kustomer in 2015, he envisioned sales to small and medium businesses. However, the company soon discovered — similar to Nugget — that its true market was elsewhere. In Kustomer’s case, that market was enterprise firms.

As a result, “We knew we needed leaders,” Birnbaum said. “We had an immediate focus on improving and upgrading and enhancing our customer experience and implementation teams, as those larger customers need deeper implementations and deeper integrations.”

Kustomer also hired more senior account executives and sales enablement folks. “We quickly had to adjust to how our [larger] customers wanted to do business with us,” he added.

Market expansion centers on determining how a company will perform — and which customers will buy

Regardless of how a company chooses to expand its market — whether through acquisition, a new product, or a new customer for an existing product — it’s clear there are risks involved if data and forward thinking don’t support strategies.

Efforts to evaluate a new market and how a company will perform in it are important considerations. Perhaps even more critical, however, is the need to identify the true customer in a market.

As Harvard Business Review noted: “The nuances of your business and the industry you’re in, as well as your company’s strategic direction, will help to shape your expansion into new markets.”