Between turbulent markets, rapid technological innovation, and intensifying competition, go-to-market (GTM) leaders in the commercial banking sector face many complex challenges.

But with those challenges come significant opportunities — for banks that can identify and act on them.

GTM Intelligence goes beyond conventional business data to provide unprecedented insights into the problems that prospective clients are trying to solve, as well as opportunities that traditional approaches simply can’t offer.

We’ve assembled this definitive guide, featuring seven actionable strategies that commercial banking leaders can leverage to identify those challenges. You’ll learn how to use the power of GTM Intelligence to identify and seize opportunities before competitors to drive strong, sustainable growth.

Define and Validate Your Total Addressable Market (TAM)

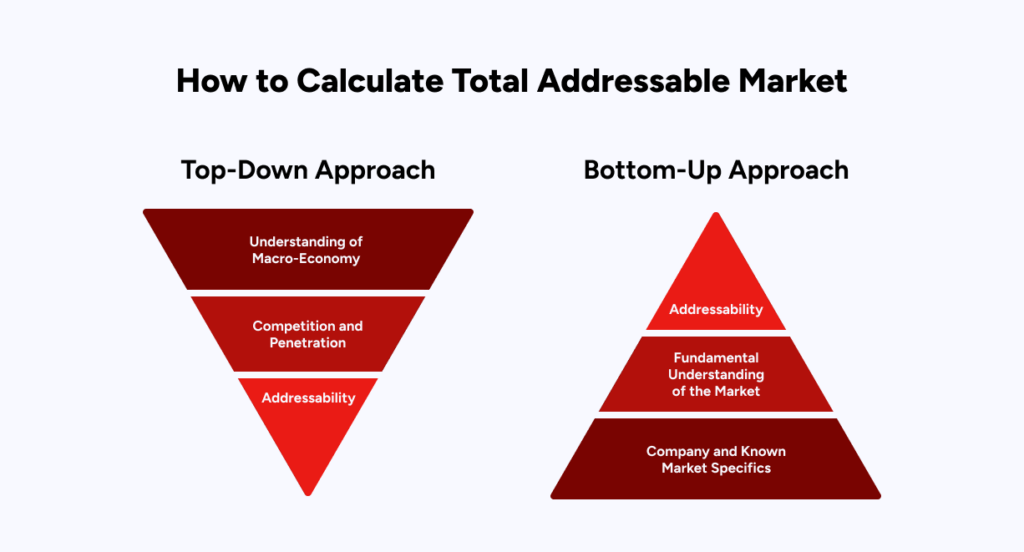

Like GTM leaders in every business, commercial bankers must have a strong understanding of their Total Addressable Market (TAM) in order to accurately identify potential opportunities.

In times of volatility, however, commercial banks must have insight into not only what their prospective clients need today, but what they are likely to need in the future. Conventional approaches to GTM make this difficult, if not impossible, because they are, by definition, reactive.

Historical data has its place. But commercial banks must be able to anticipate market movements in ways other businesses may not, particularly in rapidly changing regulatory environments.

The first step to data-driven growth is gaining insight into your organization’s true TAM. This is especially crucial for commercial banks, given that the industry is expected to grow at a compound annual growth rate of almost 15% annually until 2029 due to increased demand for financial services.

Commercial banking leaders are undoubtedly familiar with conventional methods of calculating TAM. What they may not know, however, is the true scope of their TAM. Unless they’re relying on GTM intelligence, they have little choice but to work with outdated information based on historical trends that may no longer be accurate or relevant.

Many commercial banks miss out on high-value prospects simply because their data is incomplete or outdated. Accurately defining and validating your TAM ensures that your expansion strategy is rooted in trustworthy, actionable intelligence, not guesswork and assumptions.

With GTM Intelligence, your bank can:

Map every potential commercial client within your ideal customer profile (ICP)

Segment and prioritize accounts using firmographic, financial, and industry-specific data to maximize the impact of existing and future outreach

Validate true market size and demand through revenue trends, business growth indicators, and expansion signals

By refining your TAM, your team can focus on the most profitable opportunities and avoid wasted effort on low-value prospects.

Identify Key Decision-Makers and Buying Committees

In commercial banking, trust and established relationships drive revenue. However, targeting the wrong contacts — or only engaging a single point of contact — can slow deals, stall opportunities, and increase the risk of prospective deals falling through completely.

Instead, banks must engage entire buying committees, including CFOs, treasurers, and finance decision-makers, as well as those individuals who may lack direct purchasing authority but can nevertheless exert considerable influence over potential deals.

GTM Intelligence enables you to:

Access verified contact data for C-suite executives, finance leaders, and key influencers and, crucially, map the relationships between those individuals

Identify full buying committees to ensure multi-threaded engagement, including individuals identified as being most likely to engage based on previous engagements and historical account data

Leverage AI-powered lead scoring to prioritize outreach based on the likelihood of conversion, based on quantifiable behaviors such as website activity, competitor research, even media appearances — all of which typically escape conventional measurement

By engaging the right decision-makers from the start, your bank can accelerate decisions, strengthen relationships, and close more deals.

Leverage Buying Signals and Intent Data

Not all businesses are actively looking for financial solutions, but those that are present unique opportunities.

Banks using real-time intent data can engage businesses at the right moment— when they are evaluating new financing options, expanding operations, or seeking better banking relationships. GTM Intelligence provides timely insights into the behaviors that indicate prospective clients may soon be ready to discuss their financial needs, providing invaluable opportunities to engage them before competitors.

Using intent signals, your team can:

Identify businesses actively exploring commercial banking solutions, such as seeking capital expansion, preparing for M&A activity, and exploring refinancing options

Detect early buying signals, such as leadership changes, credit facility increases, or securing new funding rounds

Prioritize outreach based on real-time market activity, ensuring conversations happen when clients are most receptive

By engaging businesses when they need banking solutions, your team can increase conversion rates and secure more profitable relationships.

Personalize Outreach with Data-Driven Precision

Generic outreach simply no longer works. Executives and business leaders are inundated with low-effort messages that will never convert, if they’re read at all. Besides wasting time, effort, and budget, one-size-fits-all outreach tells prospective clients that you don’t understand or care about their business.

Today’s businesses expect tailored engagement that demonstrates a keen understanding of their needs and offers genuine value. Data-driven personalization allows banks to craft more relevant, compelling messaging that resonates with each client’s specific financial needs.

Industry studies show that 74% of marketers say targeted messages and personalized emails improve customer engagement rates, and that segmented, personalized email drives 58% of all revenue. Put another way, personalized outreach is no longer a bonus— it’s essential to beating the competition in a ruthless market.

With go-to-market intelligence, your commercial bank can:

Tailor messaging using firmographic, behavioral, and intent insights to address unique pain points and create compelling messaging that speaks to prospective clients’ most urgent problems at the precise moment prospects are primed to engage

Leverage competitive intelligence to position your bank as a superior alternative by highlighting your unique selling proposition and the inferiority of competing offers

Deploy omnichannel engagement strategies such as email, LinkedIn, phone, and direct mail, to reach prospects where they are and maximize response rates

By delivering hyper-personalized communications, your team can establish and build trust faster, demonstrate a genuine understanding of prospects’ needs, and drive more meaningful engagements.

Reconnect with Past Champions and Clients

The financial services sector as a whole runs on trust, but for commercial banks, trust is critical. Data from Forrester indicates that, while overall customer satisfaction remains high, it doesn’t always translate into lasting loyalty.

With competition in the financial services sector more intense than ever before, commercial banking leaders should leverage relationships with previous clients and past champions to strengthen their position and drive growth.

Beyond brand reputation, trust is often driven by individual relationships, and existing relationships can be an invaluable source of new opportunities. Many former clients, or past champions who have moved to new organizations, are often open to re-engaging with trusted banking partners.

Until recently, tracking champion moves has been a considerable challenge. Consider how frequently people pursue opportunities at new companies, or launch entirely new business ventures. Every move is another chance for potential deals to be derailed, making accurately tracking such movements a necessity for commercial banking leaders seeking to leverage those relationships to drive business.

Go-to-market intelligence makes this process simple by monitoring dozens of signals to accurately map how, when, and where brand champions move, and contextualize these movements with previous engagements, relationships, and outreach efforts.

This enables banking leaders to:

Identify past clients and champions who have moved to high-value target accounts as it happens, preserving the continuity of those relationships

Engage previous decision-makers to reintroduce your bank’s offerings at the precise moment those individuals are ready to engage with your products and services

Monitor executive moves in real time to ensure timely, relevant outreach and eliminate the risk of running campaigns using incomplete or inaccurate information

By maintaining relationships with past champions, your bank can accelerate new client acquisitions and strengthen long-term loyalty.

Activate Data Across Your Commercial Banking Teams

Data is only valuable when it’s actionable. It must be easily accessible and seamlessly integrated into your existing workflows, and it must be available to all teams, from executive leadership to frontline GTM departments.

Recent years have seen heightened focus on “sales and marketing alignment,” but as ZoomInfo Senior Vice President of Marketing Carl Koussan-Price explains, that approach is simply no longer relevant in today’s AI-driven era.

“If marketing, sales development, and sales all have different definitions of success, inefficiency is inevitable,” Koussan-Price says. “When sales and marketing are working from a shared set of buying signals, and use the same AI tools to contextualize and activate those signals, they create a level of transparency that brings the entire GTM team together. Alignment is not enough anymore — true integration is the goal.”

Go-to-market intelligence enables commercial banks to activate insights across all client-facing teams, ensuring true integration and unprecedented efficiency:

Enrich CRM and marketing platforms with accurate, updated financial data

Equip relationship managers with real-time insights on the best accounts to engage based on observable activity and indicators of strong intent

Align sales and marketing teams to deploy high-impact campaigns targeting key segments, in-market prospects, and influential decision-makers

Use AI-powered recommendations to surface high-priority opportunities

By embedding data into your bank’s day-to-day operations, your team can move faster, engage smarter, and drive revenue growth at scale.

Measure, Optimize, and Scale

A winning commercial banking strategy is never static. It demands constant measurement, adjustment, and refinement.

While tracking key performance indicators has its place for specific teams, it’s vital that commercial banking leaders have visibility into the bigger picture beyond individual metrics. This includes historical commonalities shared by their most profitable accounts, behavioral indicators that suggest an increased likelihood of engagement and conversion, and the anticipated future needs of those accounts.

The most successful GTM teams aren’t merely running campaigns — they’re architecting entire buying journeys based on unique insights based on actionable go-to-market intelligence. They aren’t relying on outmoded analytical methods such as quarterly reporting, they’re using responsive data dashboards that reveal changes as they happen.

Best practices for measuring, optimizing, and scaling such initiatives include:

Monitoring conversion rates, engagement trends, and deal velocity to assess the impact of ongoing outreach efforts

Leveraging sales feedback to refine targeting and messaging, leveraging the expertise and firsthand experiences of sales teams to address prospective clients’ most urgent problems and capitalize on emergent opportunities

Scaling successful tactics to new verticals, industries, and regions based on quantifiable data that demonstrates alignment with broader organizational objectives

By maintaining data-driven feedback loops, your bank can continuously optimize its approach and sustain long-term, profitable growth.

Unlock Your Commercial Banking Growth Potential with a Free Audience Data Sample

Top commercial banks are already using ZoomInfo’s Go-to-Market Intelligence Platform to uncover new opportunities and accelerate revenue growth.

See the power of data-driven banking for yourself with acomplimentary, targeted audience data sample, including:

A curated B2B target list based on your Ideal Customer Profile (ICP)

Firmographic and financial insights to uncover high-value market opportunities

Behavioral and engagement data to identify businesses actively in-market

Competitor intelligence to sharpen your go-to-market strategy

Verified contact data of key decision-makers, enriched with AI-powered scoring for prioritization

Get your free audience report today and refine your commercial banking strategy with precision.