Finding and engaging with key stakeholders at scale is the only way to land the complex, multilayered sales processes that dominate today’s enterprise markets. Sales teams don’t have time to waste on rudimentary research that may lead to blind alleys: they need to get to power, fast.

Corporate hierarchy data is the best bet for unlocking enterprise decision trees and understanding the most efficient way to sell into the entire company — not just a subsidiary or branch.

In this guide to corporate hierarchy data, you’ll learn:

The key components of company hierarchy data

How hierarchies can help speed sales processes

How to discover valuable connections at scale

Why corporate hierarchy data is key for global sales strategy

The quickest way to reveal enterprise buying centers

What you should consider when evaluating a hierarchy data partner

What is Corporate Hierarchy Data?

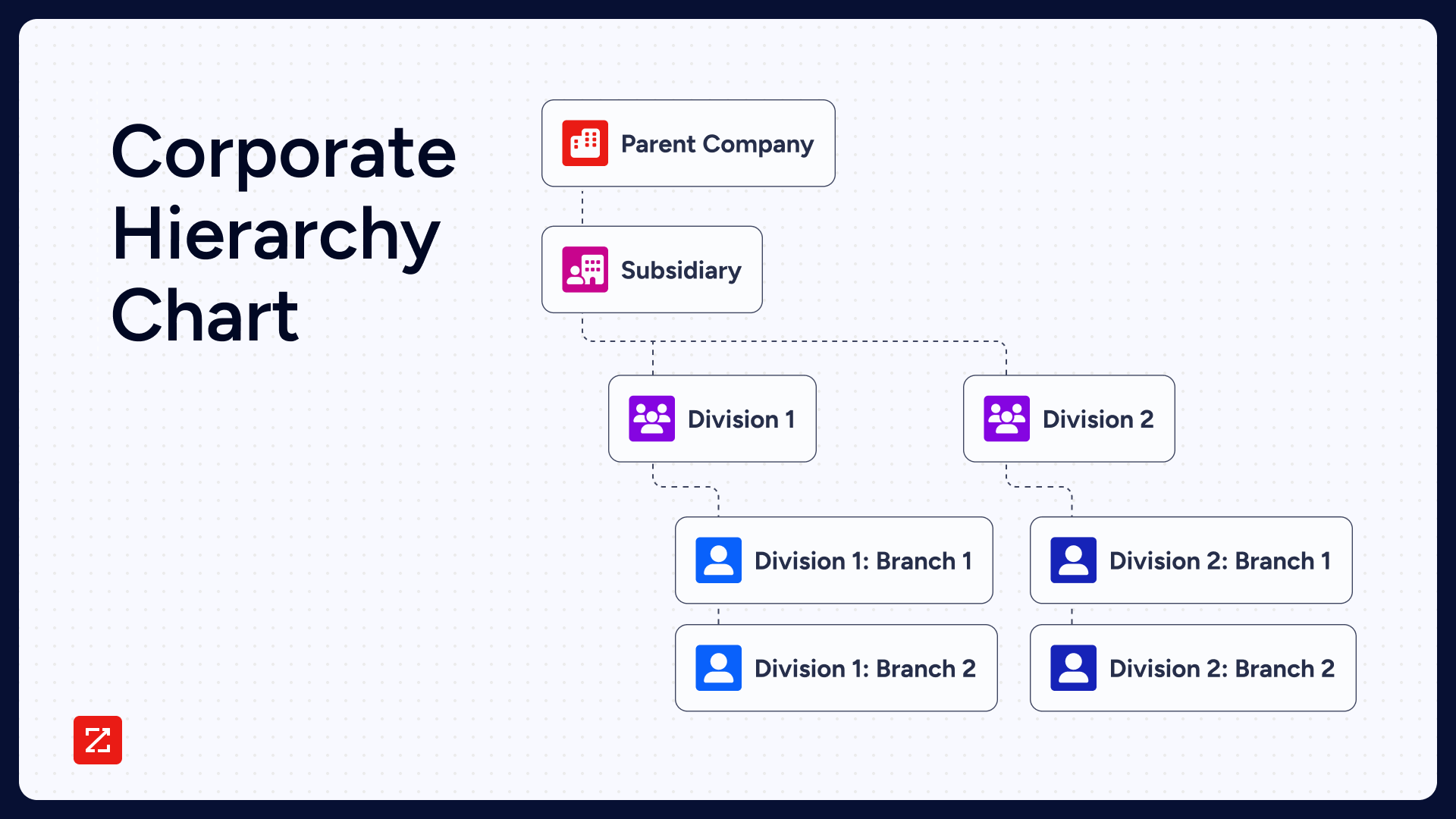

Corporate hierarchy data refers to structured information that maps the relationships between individuals and entities within an organization, including departmental reporting lines, parent-subsidiary structures, and ownership responsibilities.

Corporate hierarchy data shows an organization’s complete hierarchical structure, or the parent-child relationships between subsidiaries, divisions, branches, brands, and their parent companies. We’re looking at how Company A relates to Company B, and possibly rolls up to Company C.

In short, corporate hierarchy data reveals the structure of organizations and identifies where the decision-making power lies.

In some cases, it might just be all one company. In other cases, 10 or 20 different entities roll up into one superpower company. Once you know how entities interrelate, you can:

Identify the strongest point of entry

Uncover more enterprise opportunity for your product or service

Discover where the organizational buying centers lie

Corporate hierarchy data lets you be a lot more strategic with your sales approach, penetrate the enterprise more broadly — and sell more.

Components of Corporate Hierarchy

Corporate hierarchy data often falls under the category of firmographic data. And, it’s made up of data points related to a company’s relationships to other companies within the market. Think of company hierarchy data as something of a family tree.

This data can show you which companies own or have stock in other companies and, more importantly, how these corporate relationships impact business decisions and operations.

Here are a few examples of the important company information a sales rep can glean from company hierarchy data:

Parent:

A parent company owns a large percentage of stock in other companies and has control over their management and operations. It represents the highest level in the hierarchical system. Parent companies run their own business and operations while also managing the subsidiary companies they own stock in.

Subsidiary:

A subsidiary is a company that is owned and controlled by a parent or holding company. If a subsidiary is 100% owned by a parent company, it is referred to as a “wholly-owned subsidiary.” Subsidiaries may only have one parent company or they may have several different owners. These divisions are crucial within the organizational structure.

Division:

A division refers to a segment of a company that handles a specific area of a business. For example, Alphabet Inc. has a wide array of divisions — the main one being Google, but others including Waymo, DeepMind, and Google Fiber. A company’s divisions may be centrally located at its headquarters or divided across different geographical branches.

Branch:

A branch is an outlet of a company that exists in a separate physical location. A company’s branches carry the same name and classifications but report to the company’s headquartered location. These branches are often key nodes in a corporate organizational structure. A branch typically exists to sell the same products in a different geographical market.

5 Reasons Sales Reps Need Access to Company Hierarchy Data

Company hierarchy data is more than just a family tree that offers context about your customers and prospects. It helps enterprise sales reps streamline and improve their entire strategy.

Enterprise sales are also known as complex sales for a reason. These deals are marked by the following characteristics:

High perceived risk

Multiple stakeholders = multiple decision-makers

Long

(six months or more)

With these added complexity to sales processes, corporate hierarchy data can leverage them and save time for these reasons:

1. Improve sales velocity

The key to sales velocity is knowing the company’s structure and involving more people earlier in the process. That allows you to reach more departments, find other use cases, and drive greater dollars.

Having each of these companies purchase your product—versus just one of them—is a larger ticket.

But additionally, by involving many stakeholders, influencers can be found within each different group. With decision-makers at each locale, eventually the parent company will agree. Each node plays a significant role in driving the organization towards its goals.

2. Deeper market insights

Successful sales reps don’t just identify and sell to specific customers—they also have a strong understanding of their target market. Company hierarchy data helps sales reps uncover key insights into the structure and relationships of businesses in their target market.

For example, are many of your customers and prospects subsidiaries of larger parent companies? Do they separate their business initiatives across different branches and divisions? Answering these questions will help inform your overall sales strategy, particularly when expanding your outreach to new markets.

3. Identify new prospects.

If you’re like most reps, sales prospecting can be one of the most annoying parts of your job. In fact, 42% of sales reps say that prospecting is the most challenging part of the sales process, according to HubSpot research. Fortunately, company hierarchy data can help you find and connect with qualified prospects faster.

Company hierarchy data allows you to not only learn about a single company, but it also provides insight into the various companies within its corporate family tree. In other words, identifying one qualified prospect can quickly lead you to several other qualified prospects.

This works with current customers as well. If you’ve been working with a company for an extended period of time and you have a great relationship with them, consider taking a look at their company hierarchy data. If you find parts of the company hierarchy that you have yet to sell to, consider asking your customer for a referral.

4. Reach decision-makers faster

A typical B2B purchase involves numerous different decision-makers, which is a big reason the B2B sales cycle is longer than the B2C sales cycle. Sales reps can leverage high-quality contact data to reach decision-makers quickly — including company hierarchy data.

For instance, a small tech company you’re selling to may be a subsidiary of a larger parent company. Connecting with executives can accelerate movement through different management levels. Because the parent company oversees the smaller company’s budget, they ultimately need to sign off on any major purchases. Business strategies often require approval from chief officers before substantial investments.

So, you decide to contact key executives at the parent company that oversees your target buyer’s operations and management. In this example, company hierarchy data helped you remove a time-consuming step in the sales process (waiting for the tech company to discuss the purchase with its parent company) and, as a result, you were able to shorten the sales cycle.

5. Identify cross-selling opportunities

Cross-selling refers to the practice of selling additional products to an existing customer. While it can help you maximize revenue, cross-selling comes with its risks. The biggest risk is this: Compromising your relationship with an existing customer by continuously pushing more products on them. But, company hierarchy data helps sales reps take a more strategic approach to cross-sell.

For example, let’s say you want to sell your new mobile analytics application to a company that already buys your most popular product, a marketing automation tool. Using hierarchy data, you discover that this company has a separate division handling the production of in-house mobile tools. You decide to contact this division directly since they are better suited to understand the added value of a mobile app.

Where Can Sales Apply Corporate Hierarchy Data?

By understanding corporate structures, you can sell while being mindful of keeping other groups informed, building groundswell, and earning the approval of parent companies.

Educating, understanding influence, and driving action can happen so much faster if you’re aware of all related companies. If you miss the fact that there’s a parent company controlling the purse strings, you’ll be reinventing the wheel each time.

Let’s look at a couple of different examples: a coffee company and a Software as a Service (SaaS) company.

Hierarchy Matters Less for Simple Purchases

Coffee: You probably drink it. You definitely know what it is. Now think about this structure of A, B, and C companies: As a coffee salesperson, you’ll bet you can have buyers in each company taste it, love it, and purchase it—all within their own four walls. Visualizing this structure helps highlight communication lines.

You don’t think you’d have to go get corporate approval from Company A to purchase coffee at Company C.

Understanding Corporate Structure is Critical for Complex Sales

But let’s take a more complex example of a sales cycle: cloud storage. Much different sales process than the example above!

Suppose an individual sales rep within a SaaS company tries to sell cloud storage to Company C … but they don’t know their corporate hierarchy. They don’t know about Company B, and they don’t know about parent Company A.

They are going to engage Company C and educate them about their product. They’re going to listen and learn about Company C’s business challenges. And if the solution is better positioned than the current vendor, or if they don’t have a vendor, they’re going to try to eventually influence them to take action and buy the product.

Find Valuable Connections You May Not Know You Have

Imagine you want to reach out to an enterprise security firm you’ve had your eye on for a while.

The company recently closed a new round of funding, and you decide the time is right to connect. You discover through corporate hierarchy data that the company is actually a subsidiary of another company where your former colleague works, and that colleague is more than happy to make an introduction.

This important connection may have remained undiscovered if you hadn’t known about the enterprise relationship between the two companies.

In today’s complex sales environment, those are connections you can’t afford to miss.

Warm referrals can help you forge real relationships faster, and establish a foundation of credibility and trust that leads to long-term partnership (versus one-time transactions).

Uncover Enterprise Buying Centers

The purchasing process of every enterprise is as different as the enterprise itself, so the only rule of thumb for finding buying centers is “constant requalification.”

In other words, as you’re selling, you’re constantly making sure that your prospect is the right person, in the right department, at the right entity, to actually close the deal. It’s a continual process of discovery and confirmation.

Ask ongoing qualifying questions in an evolving landscape. Once you establish your best first point-of-entry, your goal is to learn as much as possible about that enterprise’s end-to-end buying process.

To do this, ask qualifying questions on an ongoing basis:

When and how do you envision rolling this out to your team?

From the time we hang up to the time we sign an agreement, what needs to happen?

Can you walk through that process?

Are their other people or departments who need to play a role in the decision?

Exploring these queries can uncover overlooked enterprise relationships. Sometimes the answers to these questions involve other entities entirely. In the case of ABC Television, for instance, the news outlet may need your solution and advocate for it, but the purchasing itself would likely happen at Disney, the corporate parent.

If you know this early on in the sales process, you may be able to sell your solution to other entities owned by Disney (especially if it’s a software solution).

Result? A more massive sale. In the case of a national retailer, for example, you wouldn’t expect individual stores to purchase their own applicant tracking systems.

Why Hierarchy Data Belongs in Your GTM Stack

Corporate hierarchy data is more than org charts: used well, it’s a force multiplier for every stage of your enterprise sales motion. Hierarchies show you where the power lies, who has influence, and where decisions are really made.

With the right hierarchy data, you have a map to navigate from outreach to closed-won. Without it, you’re likely to be stuck in dead ends and side streets, missing high-value opportunities hiding in plain sight. Level hierarchies often determine which stakeholders are involved in B2B processes.

ZoomInfo has spent nearly 20 years building the best hierarchy data solutions in B2B, mapping over 100 million companies and revealing the constant shifts and changes in valuable corporate hierarchy data.

That’s what GTM Intelligence is all about: actionable insight, not just information. Want to run a smarter GTM motion? Start by mapping the company. Then move.